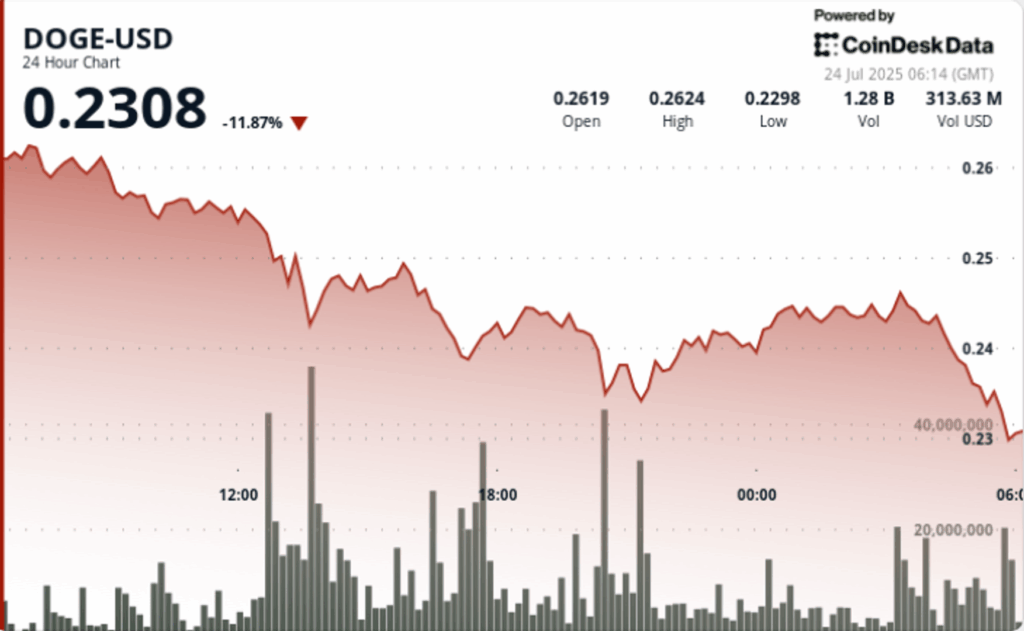

Dogecoin registered a strong decrease during the negotiation session from July 23 to 24, which yielded 11% of $ 0.26 to $ 0.24 in the middle of sustained institutional pressure and extreme volatility.

Commercial volumes increased more than 2.26 billion tokens during the sale window, marking one of the highest activity peaks in recent weeks. Analysts cited a broadtest fragility and profits from the cryptocurrency market of large headlines as key promoters of the move.

Despite a brief rebound of the level of $ 0.23, Doge failed to recover the resistance to $ 0.25, closing near the minimums of the session and increasing the risk of continuous pressure down.

What to know

• Doge fell 11% of $ 0.26 to $ 0.24 during the 24 -hour session that ended on July 24 at 05:00 GMT

• Intradía range of $ 0.032 marked 12.06% volatility, driven by intense sales pressure

• Seals concentrated for 13: 00–17: 00 GMT when Dege rejected $ 0.25 in 2.26b+ volume

• The final time saw 1.45% an additional drop from $ 0.24 to $ 0.24, confirming a continuous weakness

• The support was temporarily formed at $ 0.23 but could not boost sustainable recovery

News history

The feeling of the market is still fragile through the Altcoins as macroeconomic concerns, particularly around global commercial tensions and the tone of aggressive policies, excavate risk flows.

Dege saw a brief bullish speculation after the Bitin Treasury announcement earlier this month, but Momentum faded quickly when institutional players began to relax the positions.

Analysts point out the technical exhaustion and breakdown of the line of trend as triggers for the last section down.

Summary of the price action

Doge quoted within an intradic range of 12% of $ 0.26 to $ 0.24. Most of the reduction occurred between 1:00 p.m. and 5:00 p.m. on July 23, with multiple rejection wicks at the level of $ 0.25 accompanied by volumes of greater sale. A critical breakdown followed at the time of final negotiation between 04:48 and 05:47 GMT, since the Token dropped an additional 1.45% at an acute volume tip of more than 30 million tokens between 05: 04–05: 07. The price temporarily bounces at $ 0.23, but could not claim the resistance.

Technical analysis

• According to the technical analysis model of Coindesk Research, $ 0.25 has been established as firm resistance after multiple rejection candles in large volume.

• The final time showed a steep rejection of a range of $ 0.24– $ 0.24 with high liquidation activity

• $ 0.23 is now the key support to monitor; The violation could extend the reduction of $ 0.21

• RSI per hour remains in overall territory, but lacks confirmation of bullish divergence

• The volume profile suggests institutional led exits instead of retail panic

What merchants are seeing

The operators are closely monitoring Doge’s behavior around the level of $ 0.23 as a key pivot for short -term address.

The lack of retention could be opened down $ 0.21, while recovering $ 0.25 in volume can suggest investment potential. The volatility remains high, and the activity of the whales is expected to continue conducting intradic swings.