Dogecoin resisted early volatility before settling in a narrow band, with an institutional anchor support for flows about $ 0.251. Whales and medium level wallets increased holdings, indicating accumulation as technical patterns are compressed in an ascending triangle. Operators are now looking at if $ 0.25 can harden on a launch base towards $ 0.27– $ 0.30.

News history

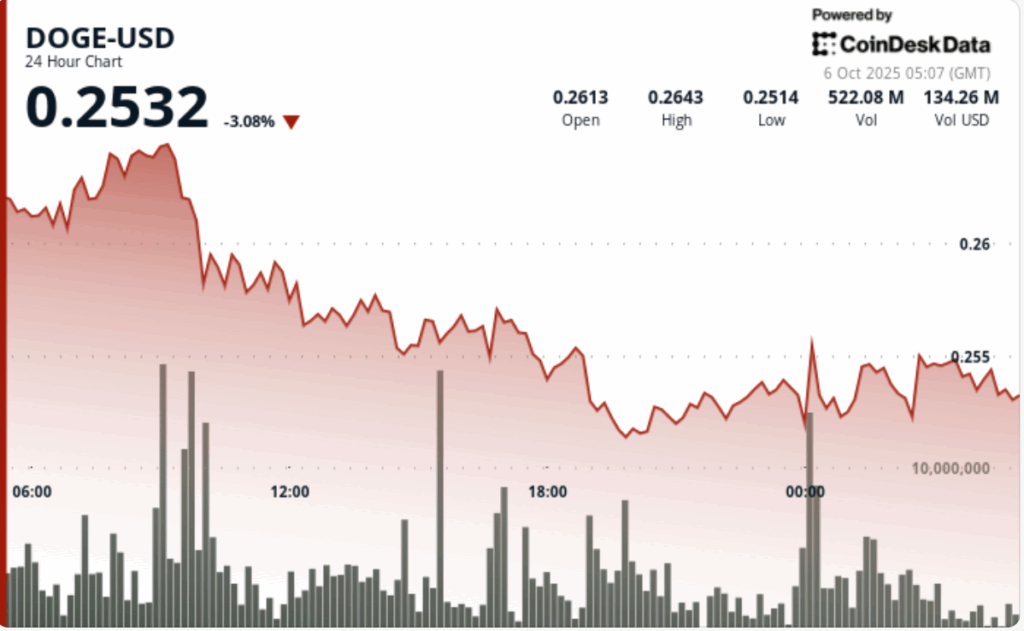

Dege traded a range of 5.3% in 24 hours to October 6, 03:00, moving between $ 0.265 and $ 0.251. The Token opened to $ 0.258, briefly recovered at $ 0.264, then vanished in the afternoon sales pressure.

In late session, the support held the firm in the $ 0.251– $ 0.252 area as a price stabilized for purchase interests about $ 0.254. The data in the chain showed medium level wallets added 30 m Doge, raising their 10.77b tokens, while the higher 1% is now directed the 96% control of the supply.

Summary of the price action

- Doge swayed through a $ 0.014 corridor, reaching its maximum point at $ 0.265 and touching $ 0.251.

- The afternoon sales task is lower, but $ 0.251– $ 0.252 support held in sustained purchases.

- Price stabilized for late negotiation at $ 0.254, hinting at the formation of the floor.

- The 60 -minute finals saw a sale of $ 0.2540 followed by a modest rebound, with volumes with an average of 5.2 million and increasing to 33.1 million during liquidation.

Technical analysis

- The key support is anchored at $ 0.251– $ 0.252, where buyers repeatedly defended the falls. The resistance is at $ 0.265, with stagnant advances to take profits.

- The structure reflects a narrow consolidation within an ascending triangle, confirmed by accumulation signals.

- The metrics in the chain suggest that the positioning is changing to large headlines, reinforcing the upward configuration. A decisive movement above $ 0.265 could activate objectives in the $ 0.27– $ 0.30 area.

What operators are seeing?

- If $ 0.25 continues to be maintained as the structural floor in the US hours.

- If the whales extend the accumulation beyond the 30 m tokens added this session.

- An attempt to break over $ 0.265 to open the road to $ 0.27– $ 0.30.

- The impact of concentrated supply (96% with the holders of the main ones) on volatility around rupture levels.