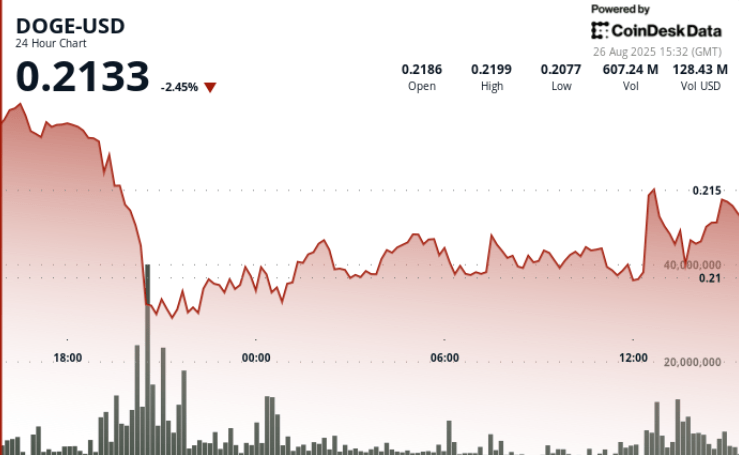

Dogecoin was negotiated through great volatility on the window from August 24 to 26, swinging within a range of $ 0.013 before consolidating about $ 0.21. A strong drop from $ 0.218 to $ 0.208 on August 25 occurred in the midst of a mass volume of 1.57 billion, while a broader pressure was linked to a transfer of 900 million Duxt to Binance that restless merchants.

Despite short -term precaution, whales continue to accumulate, leaving the feeling divided between the risks of decomposition and the optimism of purchasing sauce.

News history

- Whale transfers added fuel to volatility: between August 24 and 24, a single 900 million Dux ($ 200+ million) moved to Binance from a long -term wallet.

- The feeling of the market was attributed by the fear of a massive sale, with an open interest in the futures of Dugo who fall 8% as speculative merchants have been reduced to exposure.

- Despite the entrance, the data in the chain show that the whales accumulate more than 680 million Duxt in August, counteracting the retail distribution.

- Fed Powell’s Jackson Hole’s comments caused a Rally of the Memes Coins sector of 12%, aligning dogs with a broader impulse of risk.

Summary of the price action

- Dege registered a 6.06% differential in the 23 -hour session that ended on August 26 at 12:00, which is quoted between $ 0.221 and $ 0.208.

- The most acute movement occurred during 19: 00–20: 00 GMT on August 25, when Doge fell from $ 0.218 to $ 0.208 in a volume of 1.57 billion.

- Price also worried after the transfer of whales, swinging a maximum of $ 0.25 to test $ 0.23 support before stabilizing.

- A rebound lifted Dux from $ 0.210 session at $ 0.211– $ 0.212 in the 11: 27–12: 26 GMT window on August 26, helped by an increase in volume of 17.85 million at 11:58.

Technical analysis

- Established support at $ 0.208 after the high volume drop.

- The resistance remains at $ 0.218– $ 0.221, Tapping Rallies.

- The current consolidation between $ 0.210– $ 0.212 suggests accumulation.

- RSI recovered from oversized levels about 42 in the mid -50s, showing a stabilizer impulse.

- The MACD histogram narrows towards the Alcista crossover, pointing out the potential potential reversal.

- The decrease in open interest of 8% of points to reduce speculative leverage, limiting volatility but also damping the short -term rise.

- The negotiation sustained above $ 0.21 with high volumes (+16% against averages of 30 days) strengthens the upward case.

What merchants are seeing

- The bulls point to a break towards $ 0.23– $ 0.24 If the consolidation is resolved up and the purchase of whales persists.

- The bears highlight $ 0.208 as the downward trigger, with a risk opening risk for $ 0.200.

- The strip of the war between the exchange inputs (distribution risk) and the accumulation of whales (demand for support) remains the decisive factor for the next section.