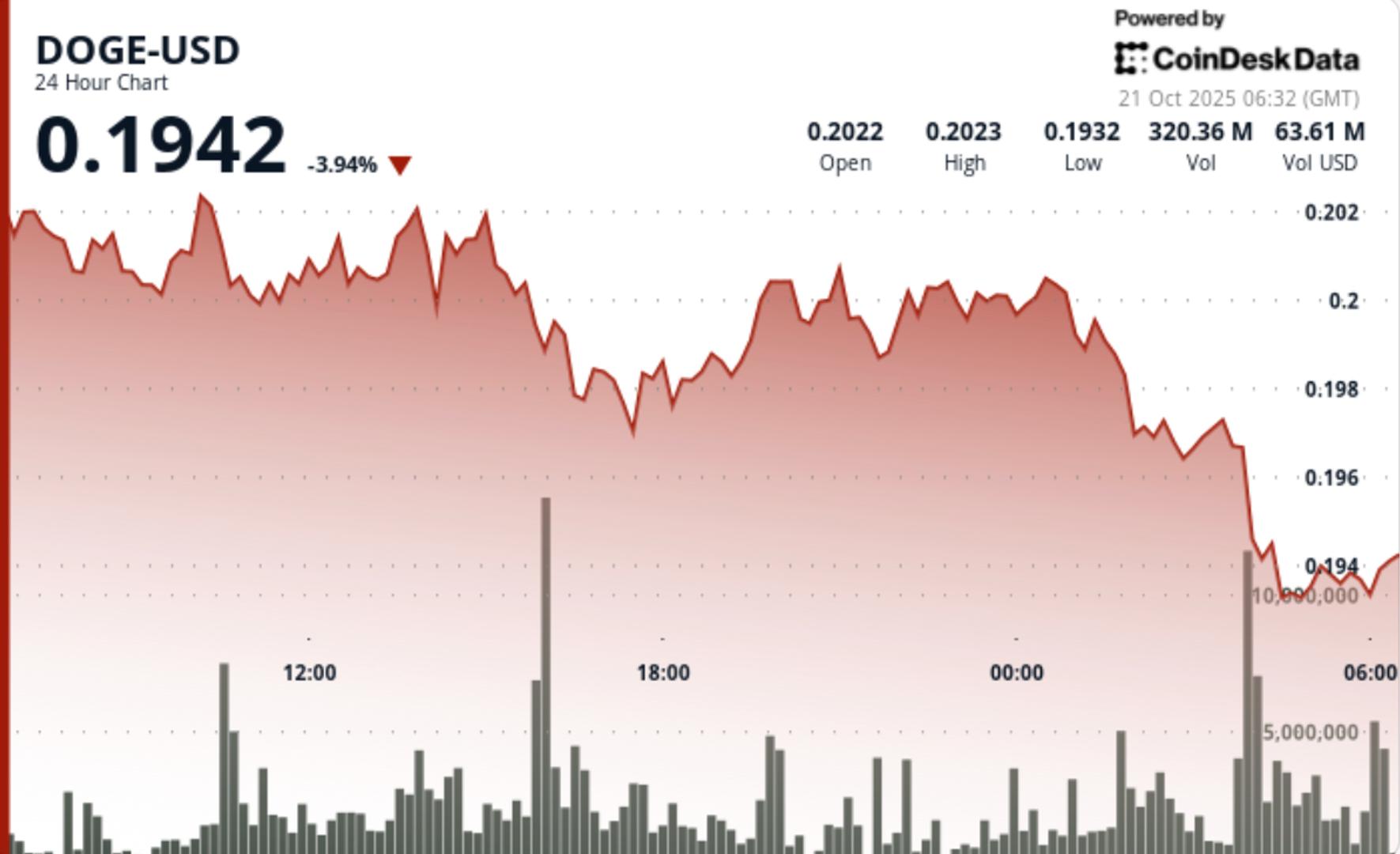

Dogecoin traded strongly over the weekend, falling 3% as institutional desks reduced risk on major companies. Selling built resistance near $0.20 after multiple failed breakout attempts, while macro stress keeps traders on the defensive in alternative markets.

News background

DOGE’s pullback comes after a week of volatile flows between assets sparked by new headlines about tariffs between the United States and China. Institutional sentiment shifted away from risk as macro funds reduced exposure to cryptocurrencies along with broader deleveraging in altcoin futures. Regulatory overreach due to pending US Treasury rules adds pressure as corporate treasuries reduce cryptocurrency allocations.

Price Action Summary

DOGE traded between $0.204 and $0.197 until October 20-21, marking a 3% range with heavy afternoon volume. In the 15:00 UTC block, 818 million DOGE changed hands, almost three times the daily average, as large sellers limited rallies above $0.20. The price fell to $0.197 in late US trading before finding limited support on low volume.

The last hour (01:10–02:09 UTC) saw another 1% drop as algorithmic triggers spiked below $0.20. Volume spiked to 40.5 million at 01:56, confirming programmatic liquidation before markets stabilized near $0.197.

Technical analysis

The structure remains bearish in the short term while DOGE remains below the $0.20 level. Repeated rejections at that level mark a clear resistance band, with next support between $0.194 and $0.196. RSI and momentum indicators remain negative but almost oversold; Traders note a potential risk of compression on any recovery above $0.201.

What traders are watching

Desks are watching for signs of stabilization near the $0.195 support. A clean recovery of $0.201 in volume could lead to short covering between $0.208 and $0.21. Failure to defend $0.194 exposes $0.187, last month’s structural base. Macro sentiment still governs direction; Any softening in trade war rhetoric could trigger a risk rally led by DOGE and SHIB.