For every buyer there is a seller, and in 2025 those sellers have been especially active.

Bitcoin has traded mostly sideways, fluctuating within roughly a 20% range around $100,000 since early 2025.

The prevailing narrative is that “OGs” or long-term holders have been dumping the coins. That’s true, but how much bitcoin has actually changed hands?

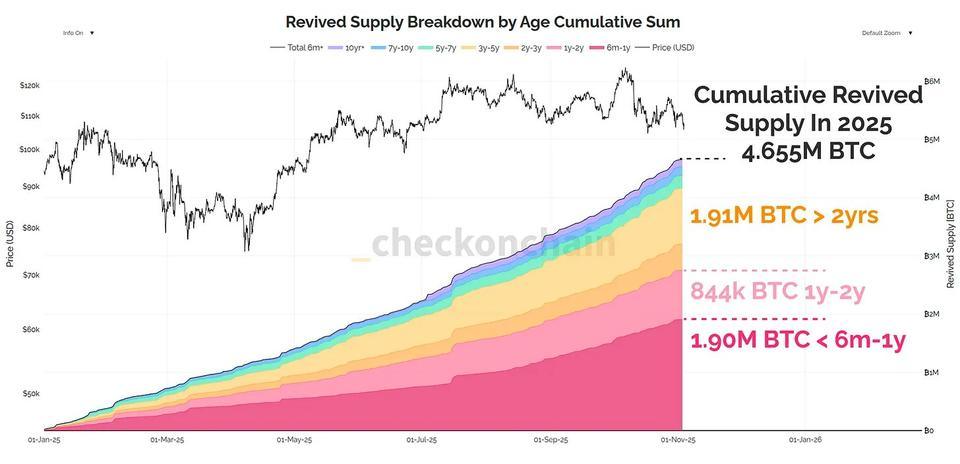

According to analyst James Check, also known as Checkmate, the revived cumulative supply (the total number of coins returning to circulation after being dormant for more than six months) reached 4,655 million BTC in 2025. This breaks down as follows:

- 1.91 million BTC from holders inactive for two years or more.

- 844,000 BTC from holders from 1 to 2 years.

- 1.9 million BTC from 6 to 12 month holders.

In dollar terms, Checkmate estimates that revived supply reached $500 billion in 2025, up slightly from $470 billion in 2024. However, in BTC terms, nearly 7 million BTC were revived in 2024, compared to 4.655 billion BTC this year.

There are several factors that drive this sales activity. The $100,000 price level represents an important psychological and profit-taking milestone.

Some long-term holders have looked to diversify into gold or AI stocks.

Some are wary of emerging threats like quantum computing, while others are responding to the four-year cycle narrative. Bitcoin has been roughly 18 months since its halving, a period that often aligns with market peaks and increased profit-taking by long-term holders.

Galaxy Research came to a similar conclusion. According to Alex Thorn, head of research at Galaxy, more than 470,000 BTC held for more than five years worth about $50 billion changed hands in 2025, the second-largest nominal amount on record after 2024.

Combining 2024 and 2025, almost half of all 5+ year old bitcoins spent were moved during these two years, representing 78% of all BTC spent in dollar terms.

In total, more than $104 billion in dormant currencies have been redistributed from old to new hands in the two years, according to the note.