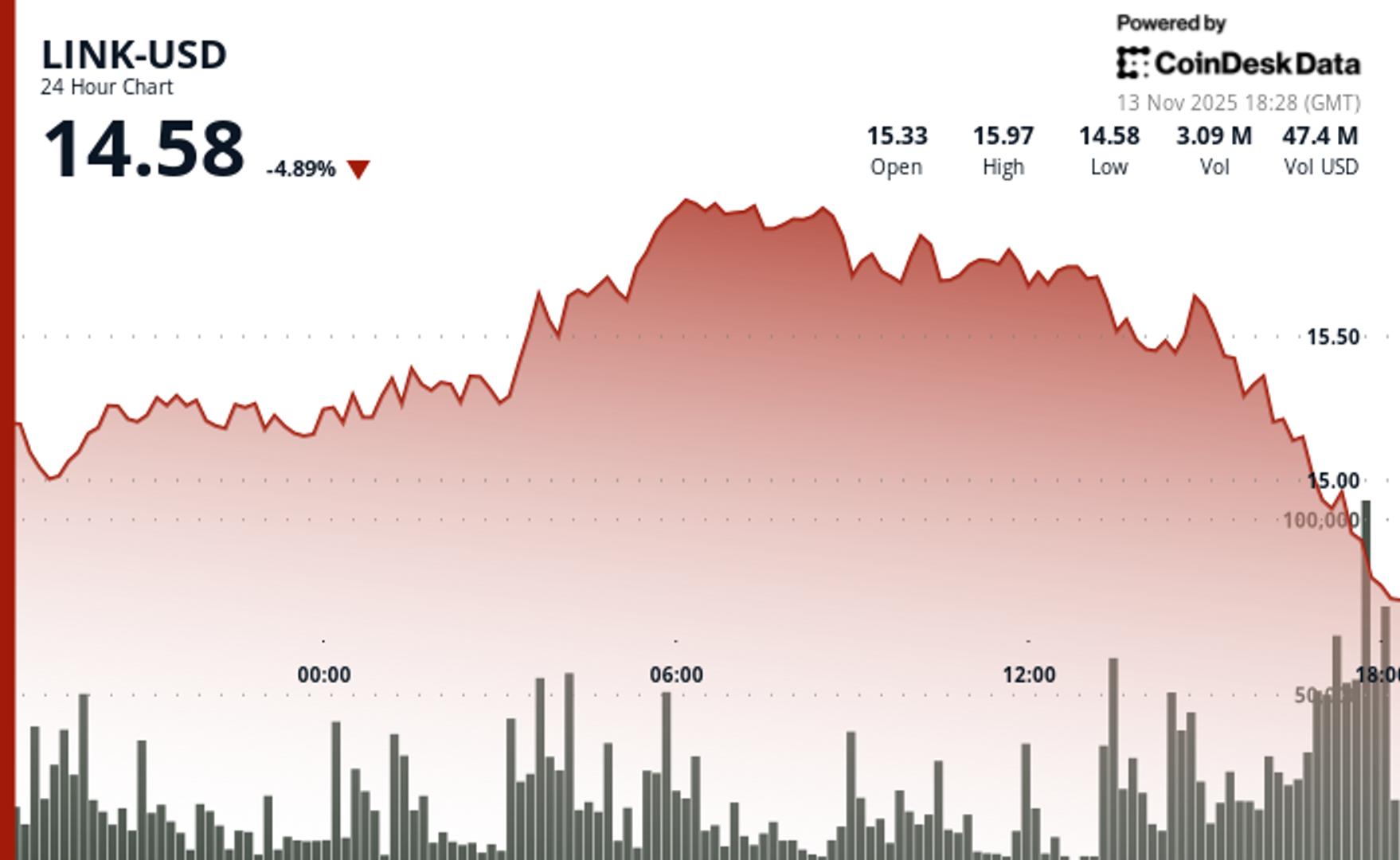

Chainlink LINK The token extended its decline throughout Thursday, falling nearly 5% in the last 24 hours and breaking below $14.50 as technical sellers overpowered buyers.

LINK fell from $15.26 to $14.73 during the day, then continued lower, marking its weakest level since late October, CoinDesk data showed. The token underperformed the CoinDesk 5 index, which fell 3.7% in the last 24 hours.

Trading volume increased to 3.32 million tokens, about 118% above the daily average, during the crash, confirming a decisive rejection of the $15.00 to $15.26 resistance range, according to CoinDesk Research’s technical analysis model. A rapid three-wave liquidation cascade between 17:05 and 17:41 UTC saw over 360,000 tokens traded within minutes, pushing LINK towards new support near $14.40 as bearish momentum accelerated.

Even with the decline, on-chain data shows a continued buildup of protocols. Chainlink Reserve purchased another 74,049 LINK on Thursday, bringing total holdings above 800,000 tokens, according to the reserve’s dashboard. Its average acquisition cost is close to $20, leaving the reserve approximately 27% underwater.

With LINK falling below $14.50, traders now face a narrower risk window: losing the $14.40-$14.50 zone could open space towards $14.20, while reclaiming $15.00 remains the threshold to stabilize near-term momentum.

Key technical levels to consider

- Support/Resistance: Between $14.40 and $14.50 acts as immediate support; Resistance lies at $15.00 and $15.26.

- Volume analysis: Breakdown volume increased 118% above average, indicating institutional-driven selling pressure.

- Chart Patterns: The clear trend line break confirms a bearish reversal from recent highs.

- Objectives and risk/reward: Holding $14.40 keeps the decline contained at $14.20; recovery requires a move above $15.26.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.