Global economic tensions and commercial disputes continue to influence cryptocurrency markets, and ETH shows resilience despite the broader uncertainty of the market.

The second largest cryptocurrency is currently browsing a critical technical area between $ 2,500- $ 2,530, which analysts identify as immediate resistance that must be overcome to continue the ascending movement.

The institutional interest remains strong, since the ETFs of Ethereum Spot that record consecutive days of positive entries, indicating a growing confidence of the largest investors despite the recent volatility.

TECHNICAL ANALYSIS

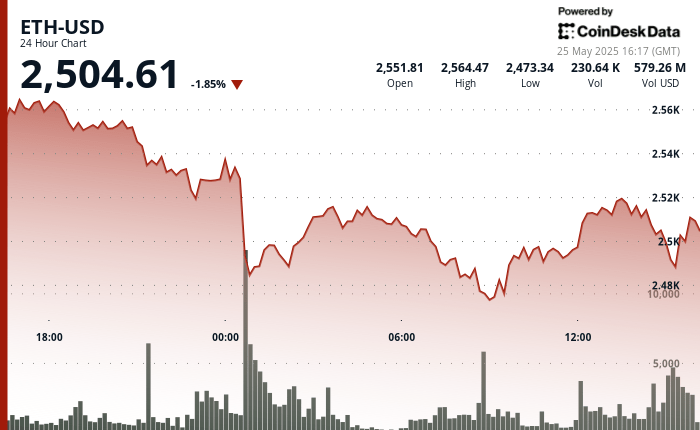

- The ETH price action 24 hours revealed a substantial range of 3.5% ($ 99.85).

- Sharp Sell-off during midnight, the price of the mountains collapsed to $ 2,477.40, establishing a key support zone.

- The extraordinary volume (291,395 units, almost 3x average) confirmed the importance of the support level.

- Buyers intervened in the $ 2,467- $ 2,480 support band, confirmed by the high volume accumulation during the period 08: 00-09: 00.

- The recent price action shows an upward impulse with ETH claiming the level of $ 2,515.

- The pattern under potential under suggests that correction may have found its butt.

- The $ 2,520- $ 2,530 area remains the immediate resistance to overcoming the continuous movement up.

- The significant increase in the bullish wave at 13:35 saw the price of $ 2,515.85 to $ 2,521.79, accompanied by an exceptional volume (5,839 units).

- The acute investment occurred at 14:00, with a price falling 5.07 points to $ 2,508.02 in heavy volume (4,043 units).

- The range of 14.46 points ($ 2,508.02- $ 2,522.48) demonstrates market indecision.

External references

- “Ethereum remains above the key prices: the data point to the level of $ 2,900 as a bullish trigger,” NewsbTC, published on May 24, 2025.

- “Ethereum Form H&S Inverse H&S – Bulls Eye Breakout above the level of $ 2,700”, Bitcoinist, published on May 25, 2025.

- “Ethereum pricing analysis: ETH is prepared for a ‘healthy’ correction?”, Cryptopotato, published on May 25, 2025.