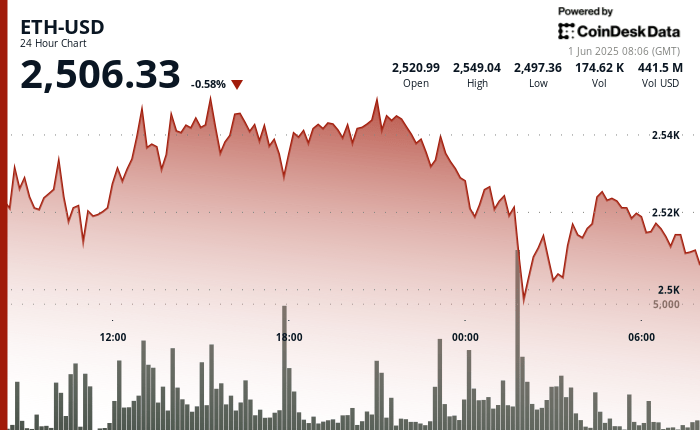

Ethereum (eth) faced a renewed low pressure in late trade, which falls below the level of $ 2,500 as the sales volume increased and the feeling of broader risk was weakened. Global commercial tensions and renewed tariff risks of the US have caused risk flows, with digital assets that increasingly reflect traditional markets in their reaction to geopolitical uncertainty.

The data in the chain revealed considerable entries to centralized exchanges, especially 385,000 Eth a Binance, a little to the speculation that institutional players can be cutting positions. Although ETH has recovered modestly to operate around $ 2,506, market observers are closely observing if buyers can defend this level or if another leg is imminent.

TECHNICAL ANALYSIS

- ETH negotiated within a volatile range of $ 48.61 (1.95%) between $ 2.551.09 and $ 2,499.09.

- The price of the action formed an upward channel before decomposing in the last hour.

- Heavy sale emerged about $ 2,550, with accelerated profits in acute investment.

- ETH fell from $ 2.521.35 to $ 2,499.09 between 01:53 and 01:54, with a combined volume greater than 48,000 ETH in two minutes.

- The volume was normalized shortly after, and the price was recovered slightly, consolidating around the $ 2,504– $ 2.508 band.

- The level of $ 2,500 is now acting as an interim support, although the impulse is still fragile with distribution signs still evident in recent volume patterns.

External references