Ether (eth)

has increased 1.28% in the last 24 hours to reach $ 2,538.25. This occurs when the new Coinshares data show that ETH attracted $ 295 million in weekly tickets, most of any digital asset last week. The increase carries monthly flows to $ 296 million and raises the total assets of Ethereum under administration at $ 14.09 billion.

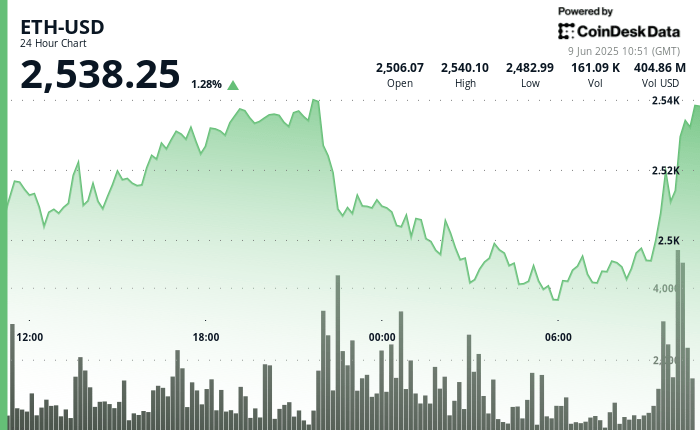

Technically, ETH recovered from the previous weakness to re -test the resistance level of $ 2,540 after consolidating about $ 2,500, according to the technical analysis model of Coindesk Research.

Recovery reflects renewed confidence among institutional investors, who have now supported 15 consecutive negotiation days of Spot ETF net entries according to Sosovalue. Combined with constant defi and a rethinking growth, ETH seems to be ready to benefit if it can firmly clarify $ 2,540.

TECHNICAL ANALYSIS

- ETH quoted in a 24 -hour range of $ 57.91 (2.31%), between $ 2,482.99 and $ 2,540.10

- Key resistance maintained at $ 2,540 while the support formed around $ 2,483- $ 2,485

- A rupture at 08:02 saw ETH arises 1.33% in 8,337 volume units

- The negotiation volume reached its maximum point at 253,612 ETH during an acute investment

- The price structure reflects a possible bullish flag with a golden cross between the mobile averages of 50 and 200 days

- Consolidation above $ 2,520 suggests that buyers remain in short -term control

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.