A strong setback through cryptography markets on Tuesday caused almost $ 735 million in bulls with the worst part.

Ethher (ETH) and XRP tracked futures bets reserved larger losses than Bitcoin in an unusual movement, indicative of the greatest interest towards Altcoin merchants last week.

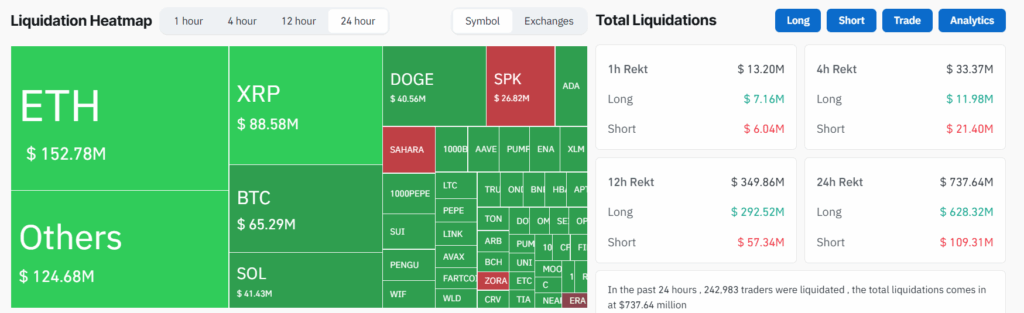

Coinglase data show that ETH merchants lost $ 152.78 million, the largest for any asset, followed by $ 88.58 million in liquidations for XRP. Bitcoin arrived third at $ 65.29 million, despite its largest market capitalization and deeper liquidity.

Although the price action in the largest was reduced mainly for only a few percentage points, the high influence used by retail merchants in Altcoins probably amplified their losses. In total, $ 625.5 million of the liquidations were in long positions, which suggests that the sale of the sale of many offspring after weeks of upward impulse.

Other very successful chips included Sol de Solana at $ 41 million, Dogecoin (Doge) to $ 40 million and tokens defi smaller as SPK and pump watching more than $ 10 million in clean positions.

The absence of a clear catalyst and the profits near the key resistance levels may have exacerbated the sale of the sale. Ether recently flirted with the $ 4,000 mark, while Bitcoin quoted above $ 118,000, levels that had already caused larger wallet earnings reserves.

At the time of writing, ETH fell approximately 3.6% in the day to operate about $ 3,540, while XRP fell 6% to $ 3.25, extending its weekly loss to more than 12%. Bitcoin was better, sliding less than 2% to pass $ 116,800.

Cryptographic liquidations occur when leveraged positions close by force due to a price movement beyond the margin threshold of an operator. This generally results in important losses and can trigger waterfall effects during volatile movements.

Operators use liquidation data to measure the feeling and market positioning. Large long liquidations often indicate panic funds, while short liquidations can precede a squeeze.

Picos in liquidations also help identify overpopulated trades and potential reversions. When combined with interest rate and open financing rate data, liquidation metrics can offer strategic input or output points, especially in overlegated markets prone to discharges or sudden demonstrations.