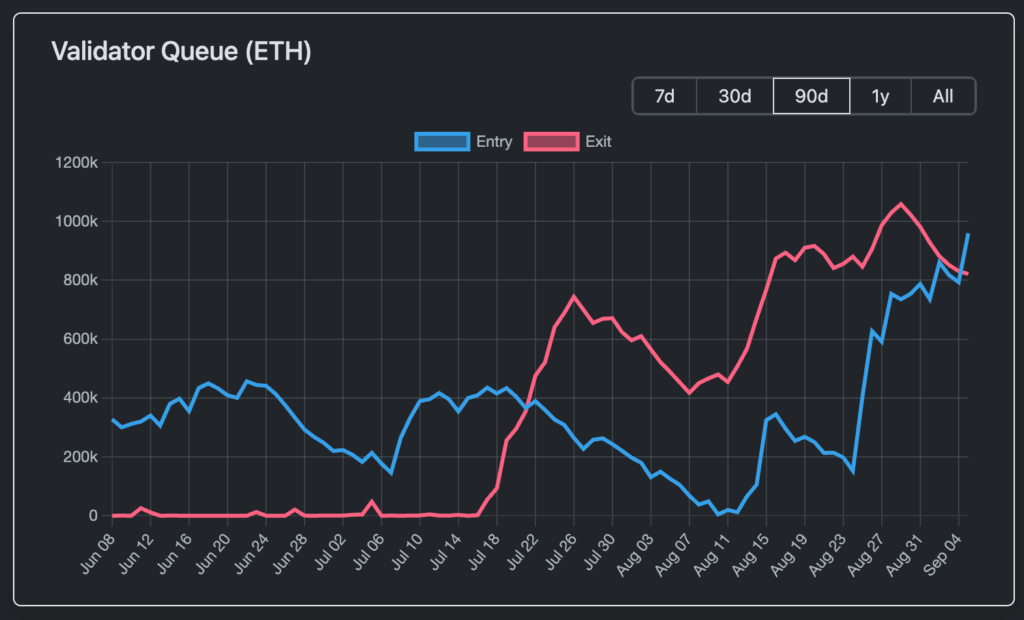

Ethereum’s validator entrance tail has overcome the starting tail for the first time in weeks, indicating a renewed demand for Ether stake (Eth) As well as fears a lot of sales.

At the time of writing, 932,936 eth ($ 4 billion) He sits in the entrance tail compared to 791,405 eth ($ 3.3 billion) In the output tail, according to the data of Validatorque.com. Three weeks ago, the exit tail stood at 816,000 ETH, which caused concerns about whether the market could absorb the sales pressure once the tokens were unlocked.

The change was partly fed by an Ethereum Ico participant who resurfaced after eight years of latency. The long -term headline moved 150,000 eth ($ 645 million) In bets earlier this week.

Read more: Ethereum ico Whata Suitable $ 646 million after three years inactive

The investor originally bought 1,000,000 ETH for only $ 310,000 during the sale of Ethereum 2014 tokens. Even after rethinking, the wallet retains 105,000 eth ($ 451 million) In two wallets, with most of their intact holdings.

Ether has decreased by around 4% since August 15, when the exit tail reached 816,000, barely the sale of the sale that many predicted despite a broader setback in the market. During the same period, BTC decreased by 7%, while several alternatives experienced two -digit decreases.

Long -term bet

The Ethereum stake test system continues to act as a release valve and a capital attractor. While last month’s exits reflected nervousness, today’s entry tail highlights confidence in long -term reference rewards and a possible structural demand for ETFs.

As the defi analyst, Ignas in August: “While the unnecessary tail is in ATH, so are the ETF tickets.”

Now, with cooled outputs and inputs, balance can be inclined towards reference as a long -term commitment to Ethereum’s growth.