Ethereum’s exit tail of Ethereum swelled on Tuesday at his longer waiting time in more than a year, which could indicate a race among the stakers to extract funds after a large price rally in Ether (ETH).

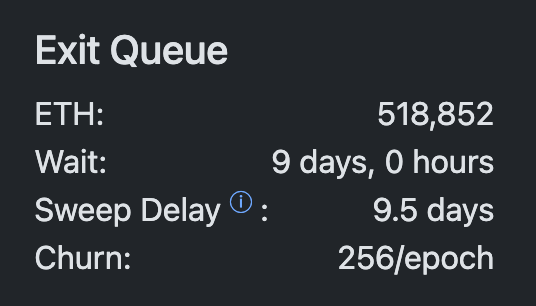

There were almost 519,000 eth as Tuesday afternoon from the USA, with a value of $ 1.92 billion at current prices, online to get out of the network, according to Validatorqueue.com data.

That the largest amount in the starting tail since January 2024, which extends retirement delays to more than 9 days, according to the data source.

The congestion is due to the dynamics of the Ethereum participation test model, which limits the speed with which the validators can join or leave the network. Validators are entities that provide tokens to help ensure the block chain in exchange for a reward.

Take profits after eth rally

It is likely that the ongoing exodus is due to the taking of profits by those who bet on ETH at much lower prices and now charged after ETH recovered from 160% since the beginning of the beginning of April.

“When prices go up, people disapprove and sell for profits,” said Andy Cronk, co -founder of the Figment Renterao Services Supplier. “We have seen this pattern for retail and institutional levels through many cycles.” He also added that innovative peaks could also occur when large institutions move custodians or change their wallet technology.

In particular, there was an increase in validators that entered the network during March and early April, a period in which ETH quoted between $ 1,500 and $ 2,000.

Eth reference demand also triggers

Although the tokens wave is not assaulted, a great sales pressure may not materialize, since there is a consistent demand to bet tokens and activate new validates.

There are more than 357,000 ETH, with a value of $ 1.3 billion, hoping to enter the network, stretching the entrance tail beyond six days, it has been longer since April 2024.

Behind this opposite dynamic there could be “a mixture of older positions that capture profits, as well as that the stakers move towards a treasure strategy,” said David Shuttleworth, Anagram’s partner.

In fact, part of this new demand can come from the new wave of ETH corporate treasure bonds such as Sharplink Gaming, which has acquired more than $ 1.3 billion in ETH since its pivot at the end of May and bet on tokens as part of its strategy.

In addition, the Bag and Securities Commission (SEC) clarified on May 29 that the bet does not violate the US values of the US, which reinforced the institutional appetite.

Underlining the trend, the number of active validators grew 54,000 from the end of May to reach a record of almost 1.1 million, by Validatorqueue.com.

“Since the SEC provided guidance on the rethinking in May, Figment has seen an increase of more than 100% in the Ethereum delegations of the institutions and an increase of more than 360% in Ethereum’s tail times, which is in line with the price increases that we have seen in Eth,” Cronk told Coinndesk.

Read more: institutions are promoting the ‘return’ of Ethereum