The 11.5% Slide of Ether (Ether in the last 24 hours has moved the second largest cryptocurrency closer to a series of gigantic liquidations of $ 340 million on the Makerdao guaranteed debt platform.

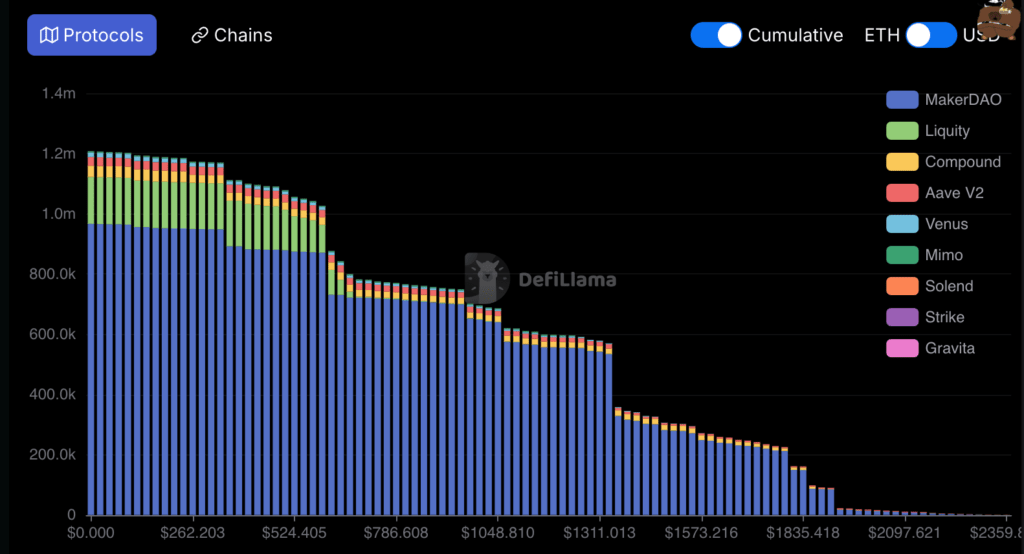

The data in the chain shows that three Makerdao positions will be settled when the ETH price range $ 1,926, $ 1,842 and $ 1,793. Each position is worth between $ 109 million and $ 126 million.

Ether, the token of the Ethereum block chain, quotes around $ 2,390 after a sales sale throughout the market caused by the diminishing feeling and a fall in global shares.

It remains to be seen if the fall is the trigger for a bearish market. The assets have generally collapsed up to 30% in the previous upward markets to shake the leverage before returning upwards, ETH has dropped by 42% since December 16.

To trigger Makerdao’s settlements, ETH needs to fall in another 19%, at which time it could cause a liquidation waterfall in the protocols and exchanges of decentralized finance (Defi).

During the last 24 hours, $ 296 million have already been liquidated in ETH positions in exchanges, according to Coinglass.

It is worth noting that the disappointment events stimulated by sales sales sales can present an opportunity for smart merchants to buy undervalued assets, since the spot price is determined by a lack of short -term liquidity and not what it could be considered the true value.