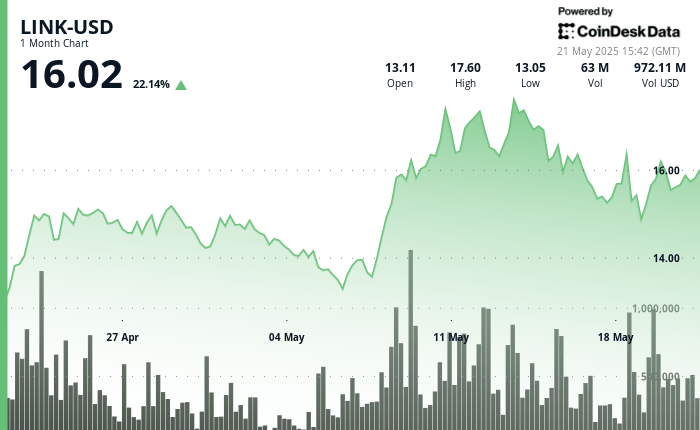

Chainlink’s price action demonstrates a remarkable resistance in the midst of mixed global economic conditions.

The Token has established an well -defined ascending channel pattern, with technical indicators that support the continuous bullish impulse.

After successfully breaking the 200 -day mobile average, Link has maintained its ascending trajectory despite short -term resistance.

The exchange exits remain consistently negative, with $ 11.27 million in exchanges that come out of link this week after $ 55.2 million in departures last week. This decreasing exchange balance pattern typically indicates the accumulation of investors instead of selling pressure.

Meanwhile, Chainlink technology continues to win traction in the Defi sector, with recent integrations that include JPMorgan, Ondo Finance and Solana Mainnet.

Link project analysts could reach $ 20 in the short term, with long -term forecasts that suggest potential growth at $ 50 by 2028 and $ 100 by 2030 as the adoption of their cross -chain interoperability protocol (CCIP) expands in the blockchain ecosystem.

TECHNICAL ANALYSIS

- Link established strong support at $ 15.60 with an emerging high volume purchase in the $ 15.27- $ 15.30 zone during a period of 18-19 hours on May 20.

- A significant volume peak (3.08m) during the 11:00 a.m. on May 21 coincided with the link that tested the resistance level of $ 16.24.

- The general trend remains optimistic with higher minimums that form an ascending clear channel.

- Link demonstrated a significant upward impulse in the last hour, increasing from $ 15.67 to a peak of $ 15.91, which represents a gain of 1.5%.

- There was a remarkable volume peak at 13:30, catalyzing a strong upward movement that established a new support level around $ 15.75.

- The price action formed an ascending channel with higher minimums, although some profits arose close to the resistance level of $ 15.90.

- The final minutes showed consolidation around $ 15.85, with volume patterns that suggest accumulation instead of distribution.

External references

- “Chainlink pricing prediction: Can the increase in the adoption of the network rejuvenate the bullish impulse for link?”, Coinpedia, published on May 20, 2025.

- “Chainlink 2025-2031 pricing prediction: a feeling of strong purchase for link?”, Cryptopolitan, published on May 20, 2025.

- “Chainlink in Rally mode: formation signals of the ascending channel continued the climb”, NewsbTC, published on May 21, 2025.

- “The price of Chainlink is directed to $ 20 as the exchange of exchange exit,” Crypto.news, published on May 21, 2025.