- Nvidia accelerators remain the company’s stronger income driver until 2028

- Hyperscalero spending could exceed $ 450 billion annually by 2027

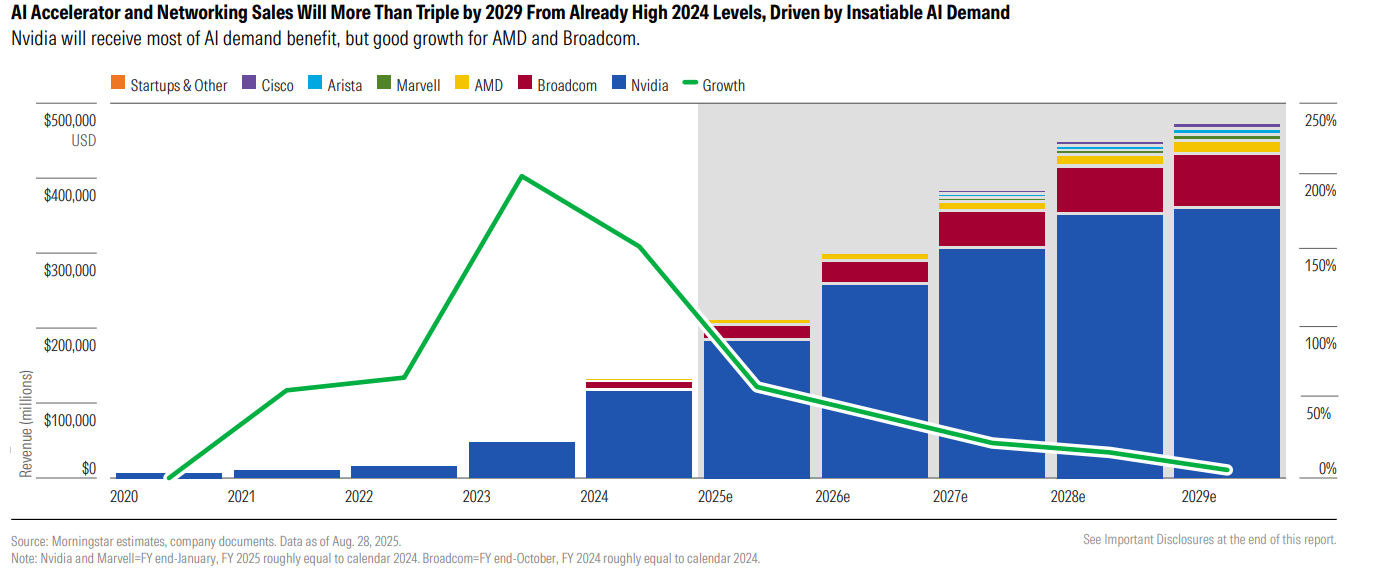

- The growth in the Hardware of AI is already showing signs of deceleration

The new predictions have affirmed that sales related to NVIDIA could approach $ 400 billion by 2028, a projection that shows the scale of demand, but also raises questions about sustainability in such a rapid market evolving.

The Morningstar Equity Research analysis states that NVIDIA’s accelerators, which cover processors and graphic systems designed for automatic learning, will continue to be the most important source of income of the company in the coming years.

With almost 40% annual compound growth projected in the accelerator market, these products could represent about half of NVIDIA’s total income by 2028.

Rapid acceleration of income driven by AI

Artificial intelligence has become the centerpiece of investment in global technology, remodeling both infrastructure and corporate strategies, and is expected to be the dominant growth driver throughout the semiconductor industry, quickly becoming an assessment anchor for NVIDIA.

However, the assumption that this trajectory continues without interruption reflects the optimism that may not completely explain the volatility of the sector.

A central driver of this growth is hyperscalera investment: cloud suppliers such as Microsoft, Amazon and Google are forecast to drive annual capital expenses beyond $ 450 billion by 2027, more than triple the levels of 2023.

This increase is initially linked to training large -scale language models and other AI tools, but it is expected to expand to business applications and government -led initiatives.

While these trends create favorable conditions for NVIDIA, they also introduce uncertainty, since the company’s short -term fortunes continue to depend on hyperscaling strategies.

The Morningstar prognosis places Nvidia firmly at the top of the AI accelerator market, followed by competitors such as Broadcom with personalized hardware and AMD with general use systems.

However, the semiconductor industry has a long history of cyclical recessions, where rapid expansion is often followed by steep corrections.

At the same time, companies throughout the value chain, including foundations, software design companies and equipment suppliers, are positioned to benefit from the demand for AI.

This growth diffusion suggests that Nvidia’s domain could face gradual erosion as competitors capture larger market shares.

A more complicated image arises when you look beyond the immediate increase, as the Morningstar table shows, while the AI accelerator and network sales are projected more than triple by 2029, the growth rate began to decrease sharply after 2024.

This creates a paradox: absolute income continues to increase, but the rhythm of increase will slowly slowly.

For Nvidia, this cooling impulse indicates a period in which to maintain extraordinary growth becomes much more difficult.

Even if NVIDIA reaches sales close to $ 400 billion by 2028, the longest -term challenges are inevitable.

The increase in energy requirements for AI data centers, the increase in government efforts to ensure the regional independence of AI and the possibility of regulatory intervention could remodel the operational environment.

Market leadership on this scale has also historically attracted political scrutiny and the greatest caution of investors, adding another layer of risk to perspectives.