Aggressive selling near the $2.66 resistance and a major Binance entry indicate a short-term distribution, while volume data shows institutional buying on dips defending $2.55.

News background

XRP’s rebound from Friday’s sub-$1.58 settlement lows lost steam overnight as fresh whale activity weighed on exchanges. A single transfer of 23.9 million XRP (≈$63 million) to Binance coincided with a selling squeeze that erased initial gains. The move came as open interest rose 2.4% to $1.36 billion, suggesting that leveraged positioning remains elevated even after the $32 billion market cap rally that followed Trump’s tariff-driven crypto rout.

Broader risk markets stabilized as trade war rhetoric softened, but derivatives desks flagged fresh accumulations of short positions near $2.65-$2.66.

Price Action Summary

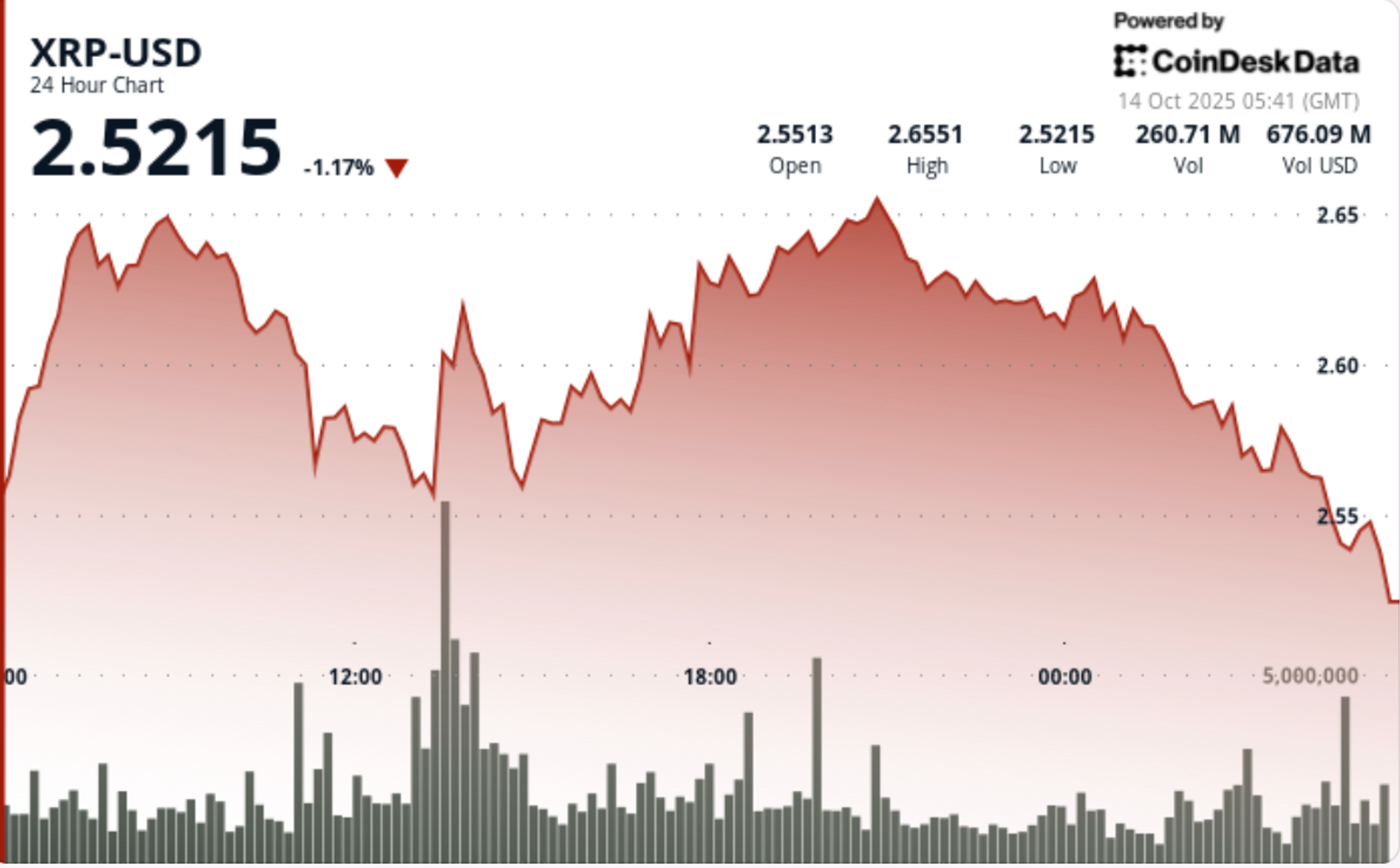

- XRP traded a band of $0.11 (4%) from $2.54 to $2.66 between October 13 05:00 and October 14 04:00.

- Volume skyrocketed to 244.6 million at 1:00 p.m., almost 3 times the average of 91.8 million, confirming aggressive buying on dips near $2.55.

- The price reached a high of $2.66 during 8pm before a sustained sell-off drove a close of $2.55.

- The bears extended control into the late hour, breaking support at $2.57 on 4M volume at 04:10, then consolidating $2.55-$2.56 at the close.

Technical analysis

The $2.55 to $2.56 zone continues to anchor short-term support after repeated high volume defenses. Resistance is firm between $2.65 and $2.66, where profit taking and whale flows caused multiple rejections.

The momentum bias is leaning to bearish as XRP trades below its 200-day moving average ($2.63), although a sustained recovery above $2.60 could reset the structure for another test of $2.70. Volume remains the key indicator: spikes in dips show institutions buying weakness, but lower highs suggest supply still exceeds demand.

What traders are watching

- Support at $2.55: Can it hold during the weekend sessions in Asia?

- Reaction to the $2.65 to $2.66 resistance zone in the next rally.

- Binance whale flows as a continuous distribution or rotation signal.

- Take advantage of liquidation potential if open interest ($1.36 billion) remains high.