Islamabad:

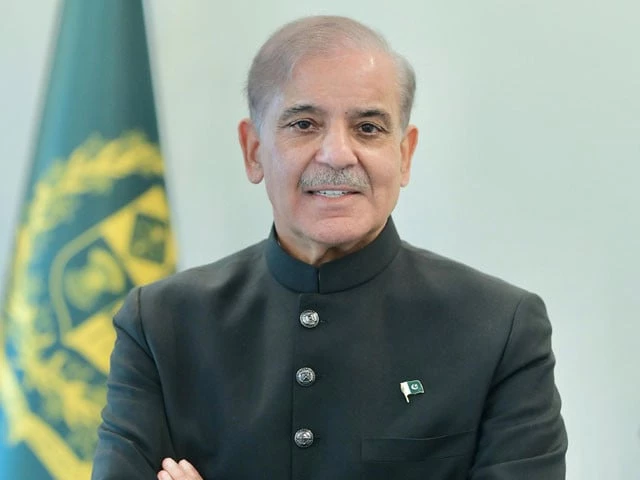

Prime Minister Shehbaz Sharif ordered the Federal Income Board (FBR) on Tuesday to use its own workforce and involve the private sector to identify the people and companies that evade taxes.

By chairing a meeting on FBR reforms, the prime minister ordered the agency to guarantee a friendly business environment and extend all possible facilities to taxpayers.

When calling regular taxpayers, the backbone of the national economy, instructed the FBR to quickly complete the directory of tax and sales taxpayers to honor taxpayers.

Honor taxpayers and evaders of reprimands will help expand the fiscal network, said Prime Minister, directing the hiring of professional services to identify tax evaders and recover income. He also asked to launch a public awareness campaign on government measures against tax evasion.

The prime minister also instructed the FBR to select the main international auditors for third -party reviews of the erroneous declaration and the lack of invocation in the customs authorization, also emphasizing a continuous third party review to identify system failures and improve it even more.

During the informative session, the prime minister was informed of the measures taken to identify tax evaders, complete the taxpayers directory and actions taken through super auditors to increase income.

The meeting was informed that the work in the taxpayers’ directory, aimed at honoring income and sales taxpayers, was quickly progressing, while a scientific audit system for third -party reviews of poor tender and the lack of invocation in customs authorization had developed.

It was also said that the Super Auditors had been designated to thoroughly review the customs authorization and the risk management system to use their production to improve the risk management system.

The meeting was attended by federal ministers Azam Nazeer Tarar, Ahad Khan Chema, Attaullah Tarar, Dr. Musadik Masood Malik, Muhammad Aurengzeb, Ali Pervez Malik and senior officials of relevant institutions.