Figment, an important player in Blockchain stagnation services, is actively looking to buy companies in a wave of consolidation of the cryptographic industry caused by renewed optimism on the regulatory clarity of the United States.

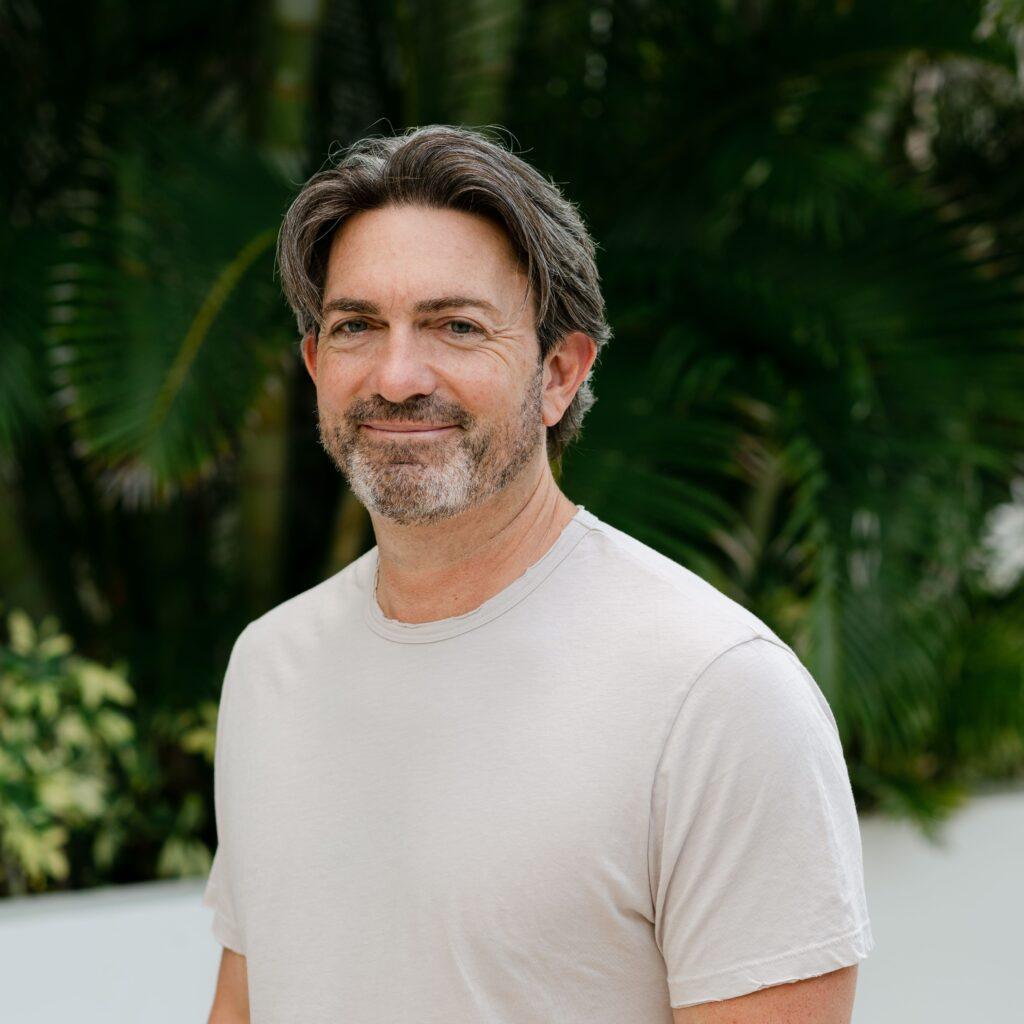

The company based in Toronto is pointing to acquisitions between $ 100 million and $ 200 million, with a strong regional presence or within the blockchain ecosystems, such as Cosmos and Solana, said the CEO Lorien Gabel to Bloomberg. He said the company already has term sheets for some agreements, the report added.

Figment helps institutions gain performance through participation, so tokens are blocked to help ensure blockchain networks and validate transactions backed by networks. Currently, the company manages around $ 15 billion in assets states and employs about 150 people, said Gabel.

The burst of cryptography agreements, which includes the purchase of $ 1.5 billion kraken from the acquisition of Hidden Road of $ 1.5 billion Ripple and Ripple, occurs when the Trump administration brought a more friendly regulatory environment with the cryptomonitan. That environment saw the United States Commission of Securities and Securities to leave cases against several cryptographic companies, with the paul Atkins cryptographic ally recently assuming the commission.

Despite the acquisition strategy, Figment does not seek additional funds and has ruled out a sale. Gabel, who co -founded the firm and launched three new previous companies, said he promised to build Figment in the long term. “I prefer to go to zero,” he said.

The company has raised $ 165 million to date, according to Thetie data. His last financing round of series C was directed by Thoma Bravo and saw the participation of giants such as Morgan Stanley, Starkwave and Franklin Templeton India.

Read more: Kraken to buy Ninjatrader for $ 1.5B to enter the Crypto futures market of the USA.