Filecoine

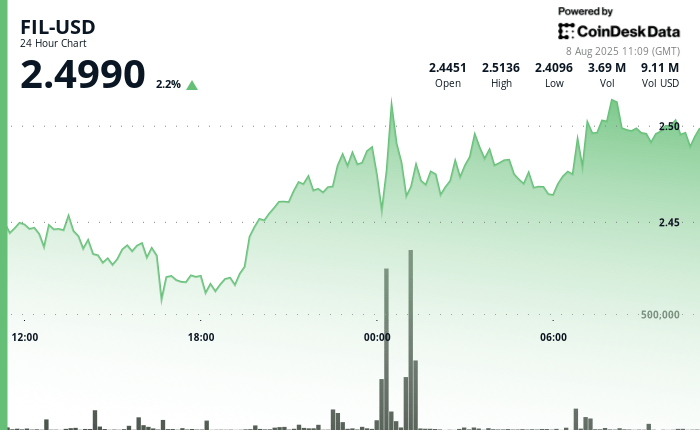

The demonstrated measured volatility, quoting within a range of 5.4% in the last 24 hours, according to the technical analysis model of Cindensk Research.

The model showed that despite experiencing a decrease in the session in the middle of the session to $ 2.39 at 4:00 p.m., Filecoin organized a recovery of textbooks and bounced by 5%.

The high negotiation volumes greater than 2.8 million units during the correction phase suggest an institutional participation, while the volume sustained during recovery confirms what market strategists characterize as a sophisticated interest of the buyer at strategic price levels, according to the model.

Filecoin Foundation and Ava Labs have launched a native cross -chain data bridge between the Avalanche and Filecoin chain C, according to an X publication. This new system connects high -speed intelligent contracts with safe data infrastructure through the Virtual Filecoin machine.

The Rally in Filecoin occurred when the broader cryptographic market also increased, with the broader market meter, the Coendesk 20, recently 3.1%.

In recent negotiation, Fil was 2% higher for 24 hours, quoting around $ 2.50.

Technical analysis:

- FIL demonstrated controlled volatility within a range of $ 0.13 that represents a differential of 5.4% between the minimum session of $ 2.39 and a maximum of $ 2.52 during the 24 -hour negotiation period.

- The ascending strategic impulse arose from 19:00 onwards, with a systematic recovery through the session during the night

- High volume activity greater than 2.8 million units during the 14: 00-16: 00 Correction Window confirmed the levels of institutional participation

- Volume acceleration greater than 50,000 units during window 10: 06-10: 07 confirmed a sustained institutional impulse that market strategists interpret as evidence of a continuous corporate adoption potential.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.