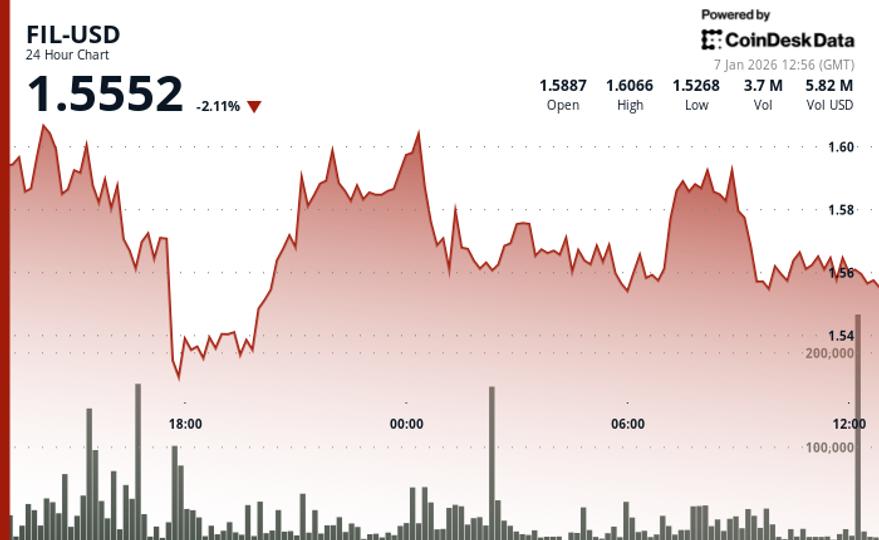

Filecoin Storage Token fell 3.6% in the last 24 hours, following weakness in the broader cryptocurrency market.

The broader market gauge, the CoinDesk 20 index, was also down 3.6% at press time.

Filecoin volume was 30% above the 30-day moving average, although participation failed to surpass elevated thresholds that typically confirm directional conviction, according to CoinDesk Research’s technical analysis model.

The model showed that the token exhibited volatility within a range. The total range measured $0.08 (5.0%) with a session high of $1.61 and a low of $1.52.

The most significant volume event materialized yesterday afternoon when participation soared to 7.30 million, 95% above the 24-hour simple moving average of 3.74 million, according to the model.

This rise coincided with a strong downside rejection of resistance near $1.60 and established critical support at $1.52, according to the model.

The model showed that the price subsequently recovered to retest the $1.59 to $1.60 resistance zone several times on declining volume, forming a consolidation pattern with support remaining above $1.55 for the past few hours.

Technical analysis:

- Primary Resistance: $1.59-$1.60 Zone Tested Multiple Times with Decreasing Volume, Indicating Exhaustion

- Critical Support: $1.52 established during peak low with volume of 7.30 million

- 24-hour participation: 30% above 30-day moving average, below high interest threshold

- Failed Breakout: Two-Minute Whiplash from $1.561 to $1.57 and Back Suggests Algorithmic Activity

- New Tests of Declining Volume: Multiple Resistance Attempts between $1.59 and $1.60 Amid Declining Participation

- Downside Risk: Breaking Support Below $1.52 Exposes Limited Technical Structure

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.