Filecoine According to the technical analysis model of COINDESK Research, 3% followed from 3% followed by a 2% decrease as volatile trade configurations emerged in the midst of evolving market dynamics.

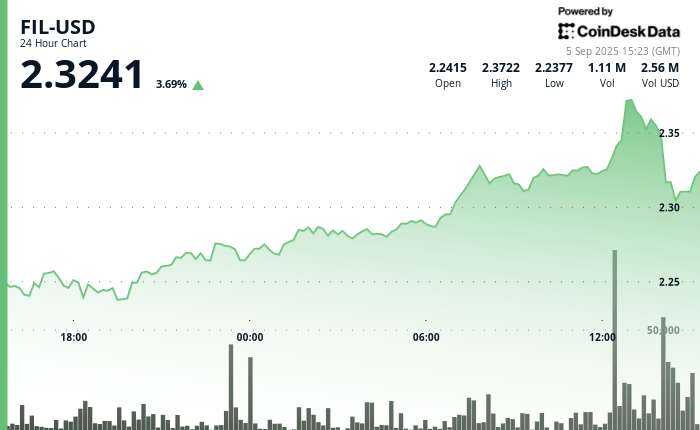

In the recent negotiation, Fil was 3.4% higher for 24 hours, quoting around $ 2.32.

The model showed that the general negotiation range was $ 0.15, or 6%, between the minimum of $ 2.23 and the maximum of $ 2.38.

Critical resistance materialized at $ 2.38 with high volume rejection during maximum commercial activity, according to the model.

The broader cryptographic market changed little, with the wide market caliber, Coindesk 20, 0.2%more.

Technical analysis:

- Fil progressed from $ 2.25 to $ 2.32 that represents a 3% gain during the previous 24 -hour period

- The general negotiation range covered by $ 0.15 (6%) between the absolute Nadir of $ 2.23 and Zenith of $ 2.38.

- Two distinctive rally phases were identified: a preliminary ascent to $ 2.28 followed by another climb on September 5.

- The price trajectory reached a maximum of $ 2.38 in an exceptionally high volume of 7.23 million, substantially exceeding the average of 24 hours of 2.47 million.

- Critical resistance materialized at $ 2.38 with high volume rejection during maximum commercial activity.

- The support levels consolidated around $ 2.23- $ 2.24 during the initial negotiation hours.

- Subsequent decrease of $ 2.36 to $ 2.32 that represents a 2% contraction during the final 60 minutes.

- Exceptional volume spikes that reach 425,701 that indicate institutional sales pressure.

- The substantial institutional sales volume reached its maximum point almost twice the average of the session during the final time.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.