When Celestia transmitted her Aunt Token to 580,000 users in 2023, it was the Plat Du Jour between merchants and investors, and the project said that the statement was aligned with a new “modular era.”

However, despite meeting with a vertiginous price of $ 20 in September 2024, since then it has collapsed to less than $ 1.65 in a difficult desperate situation stimulated by a series of mass cliffs during the excess hours of Token.

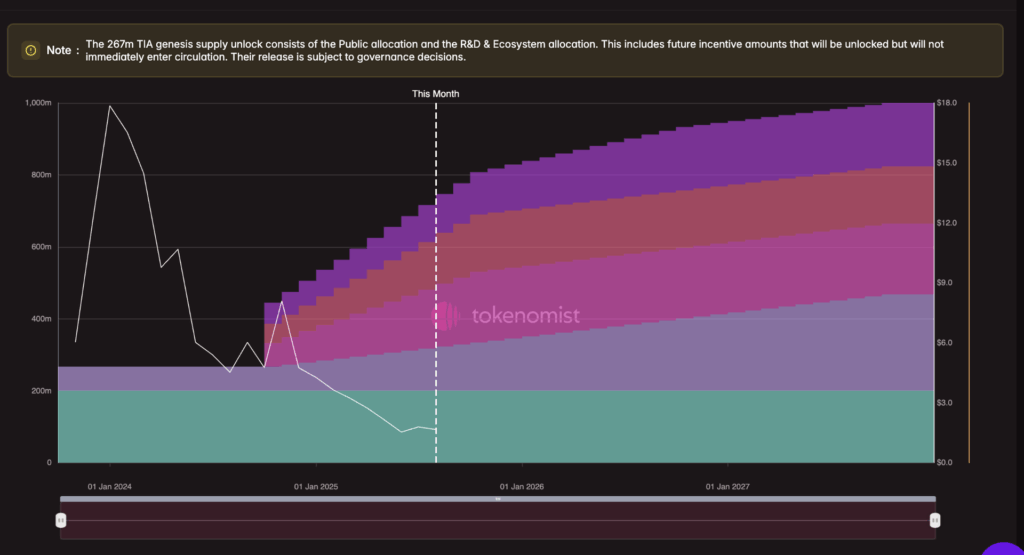

Tokenomist data show that central taxpayers and the first sponsors, in particular a series of risk capitalists, could sell tokens bought by relatively cheap fundraising rounds in the open market.

This coincided with the precipitate of Aunt towards the inconvenience, although it is worth noting that the market capitalization of the Token, currently by $ 1.2 billion, actually increased by 50% despite the fact that the Token lost 90% of its value due to the scale to increase the offer.

Other examples

The aunt pricing collapse reflects similar detainees in the newest tokens. The unlock of 10,500 million tokens of Blast in June, more than half of its supply, sent prices falling to minimum of all time while investors struggled to absorb the sudden flooding of liquidity.

Berachain also suffered strong losses after his plane and early award -winning cliffs triggered a long tight, cutting his token almost halfway from the launch maximums. Meanwhile, the Omni Network Token fell more than 50% within a day of their debut, since the first recipients rushed to sell.

These cases underline how aggressive award schedules and bad liquidity after launch continue to weigh on Token yield, even among the most publicized projects.

What’s still for Aunt: a slow squeeze or relaxed?

With the token aunt of Celestia more than 90% from their maximums, investors now observe whether the asset is playing or unraveling. After a cliff unlock in October 2024 that launched 176 million tokens (almost duplication of circulating supply), TIA has entered into a phase of stable linear emissions. Approximately 409 million more tokens are scheduled to grant at the beginning of 2027, adding continuous pressure on the price.

Some merchants see a configuration for a brief tight. According to Stix exchange chief in Taran Sabharwal, a significant portion of unlocked tokens sold without recipe, with buyers covering through perpetuals. This has led to a high open interest and negative funds, a dynamic that, if invested, could force the shorts to cover. “Financing is deeply negative,” said Sabharwal. “If that is restored, you could see a pop.”

But except for a squeery, the foundations are still weak. The monthly award continues, the liquidity is thin and the new demand for aunt is limited. Without a fresh catalyst, such as the growth in the modular ecosystem of Celestia, Tia runs the risk of a greater inconvenience, since each unlock increases the pressure in an already excessive market.