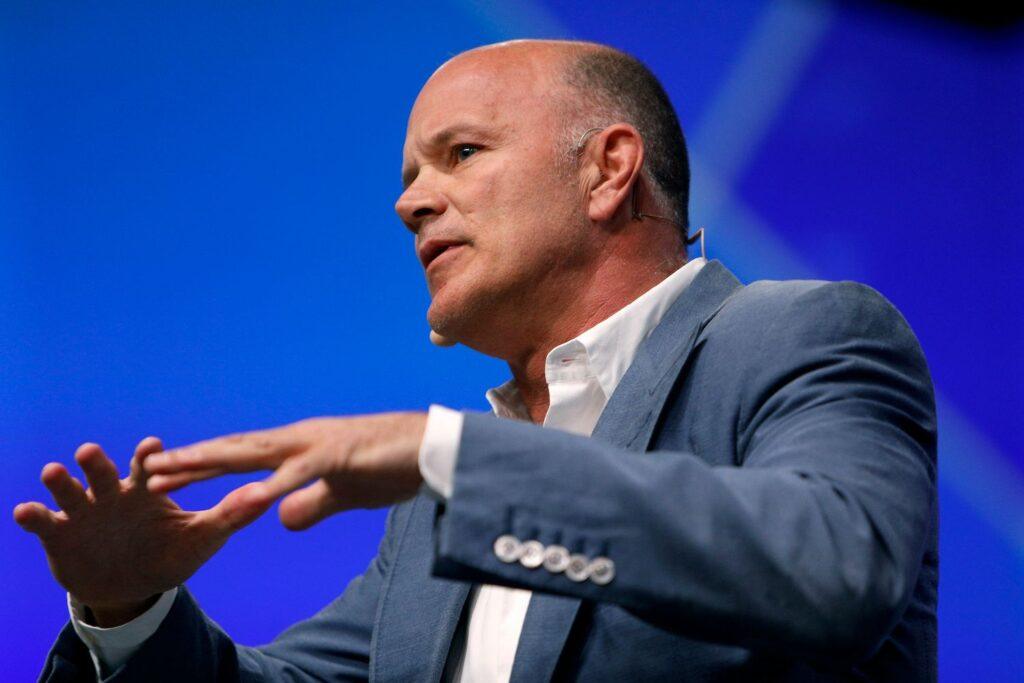

Galaxy Digital (GLXY), the cryptocurrency trade company led by Mike Novograph, is carrying its blockchain stagnation capabilities to the regulated custody specialist Bitgo Trust, despite the legal dispute between the two companies.

It makes sense to play well: the agreement brings the bet and validator services of Galaxy, which handle more than $ 4 billion in cryptography assets staked, to the clientele of institutional custody of Bitgo, which allows investors to obtain betting rewards while using assets as a guarantee for loans and commerce on the Galaxy platform.

Galaxy abandoned an agreement to acquire Bitgo in early 2023, which saw the custody sign Rententary, companies provided a joint statement:

“Galaxy and Bitgo see an incredible opportunity to further boost the adoption of digital assets and continue committed to strategic collaboration despite the current legal procedures, which are a separate issue.”

Bet, which involves blocking cryptographic tokens to support the functioning of blockchain in exchange for rewards, is a fundamental part of cryptography, and there are already indications that it will vitalize in the United States under the pro-critical administration of President Donald Trump.

Galaxy has been building non -custodial betting infrastructure, buying the node operator Blockchain Cryptomanufaktur, known as CMF, in July last year. The inclusion in the Bitgo suppliers list means being completely integrated and attached to the services ultra second and custodians and the best of both worlds, said Zane Glauber, head of the Galaxy Blockchain infrastructure team.

“Galaxy’s key differentiator are the improved products that can be made available to customers whose assets are sitting in a custody relationship,” Glauber said in an interview. “With some documentation, these assets can be accepted as a guarantee within our commercial environment. So, in addition to sitting there, assets can be used to borrow cash, or as a guarantee to participate in some type of derived strategy. “

The arrival of an American government friendly with cryptographic raises the question of when, not if, the rethinking will be included in the funds quoted by change (ETF) for underlying test tokens such as the Ether of Ethereum Blockchain (ETH).

Assuming that the rethinking will be enabled in ETF products, the managers of these funds must carefully think about the liquidity risk balance, Glauber said.

“Coating blocks its assets during a default amount of time, in Ethereum in particular, and non -union tails can be dynamic; They expand and hire based on supply and demand and dynamics in the chain, ”said Glauber. “An overlap of financial products helps improve some of these problems, providing friendly liquidity is something that is enabled by access to this set of collateral products.”