The KBW Investment Bank initiated the coverage of the Gemini Space Station (GEMI) with a market performance rating and an objective price of $ 27, which describes the exchange of cryptography as a very rounded digital asset platform ready for long -term growth.

However, the analyst Bill Papanastasiou wrote, Gemini for now remains not profitable and the discount assessment to the Coinbase competitor is justified “since the impact of

Market execution and risk are high. “

KBW said that Gemini’s ecosystem, which covers trade, custody, credit cards, rethinking, stable and tokenized shares, offers a cross -sale potential as the cryptographic market expands.

The bank highlighted the Gemini credit card business as a key growth driver, noting that it has more than 100,000 users and a strong conversion in the change activity thanks to cryptography based rewards.

Gemini became public last month at $ 28 per share, valuing the company in more than $ 3 billion.

KBW also pointed out the resolution of the GEMINI program problems to obtain renewed marketing and competitiveness.

A new association with Nasdaq could add up to $ 47.7 million in short -term revenues through custody and rethinking services for quoted companies, with more rise in tokenization trends, according to the report.

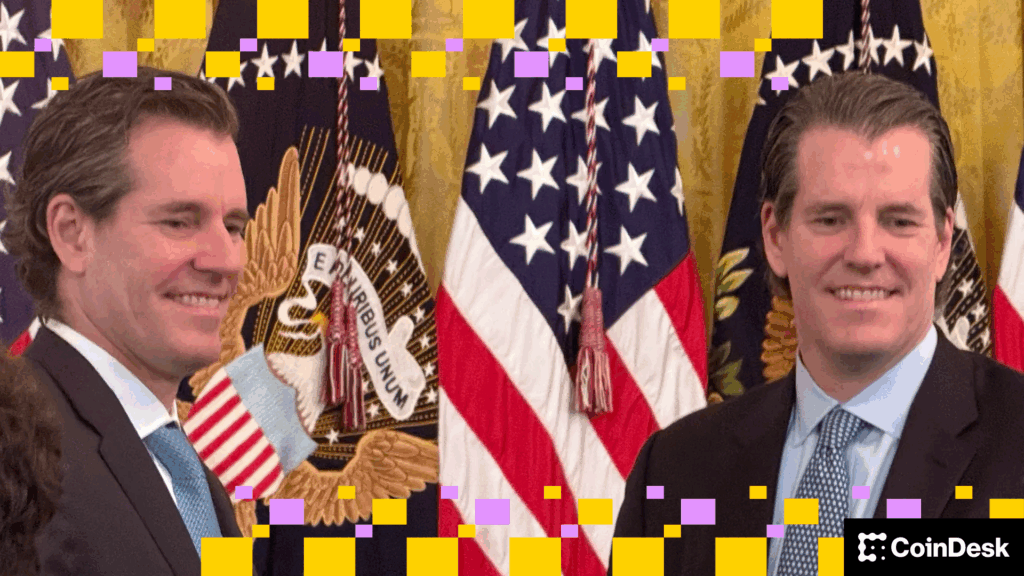

KBW cited the unified application of Gemini and the property of Strong Insider, led by the founders Cameron and Tyler Winklevos, as advantages that support the stability and growth of the user.

In general, KBW projects an annualized income growth of 53% for three years, surpassing colleagues and expects profitability at the end of 2027, calling Gemini a balanced but promising game for investors who bet on a prolonged cryptographic cycle.

The action was a higher 2% of marketing prior to $ 25.80.

Read more: Crypto Exchange Gemini’s actions are exchanged under the price of the OPI despite the day earnings