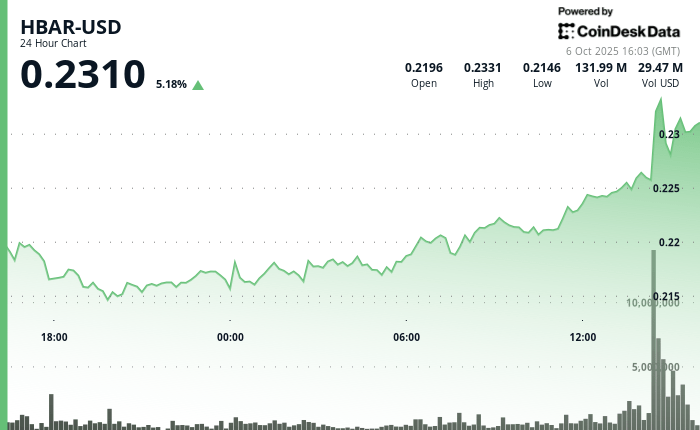

Hbar demonstrated a remarkable bullish impulse on the last day, increasing from $ 0.22 to $ 0.23 between October 5 and October 6 in an intradic range of intradic volatility of 5.47%.

The Token recovered from minimums about $ 0.21 to publish higher maximums above $ 0.23, driven by a strong purchase activity that pushed the negotiation volume of more than 70 million during peak hours.

The cryptocurrency rose approximately 3% on the 24 -hour window, extending the profits as the closure of the United States government fed the demand for alternative asset investors.

The negotiation volume increased to almost 55 million, well above its daily average of 39.85 million, pointing out the renewed market participation and optimism around the short -term trajectory of Hbar.

An additional upward impulse was recorded in the last hour of the session, with a gain of 0.46% Hbar elevation at $ 0.23, even when traditional variable income markets were pressed by ongoing commercial disputes.

Technical Indicators Sustained Force Signal

- Hbar established formidable support at $ 0.21 during October 5 of the afternoon hours with a substantial volume confirmation.

- The commercial activity of 54.99 million exceeded the average of 24 hours of 39.85 million during recovery.

- The cryptocurrency demonstrated an upward impulse sustained through multiple resistance infractions, especially exceeding the thresholds of $ 0.22 and $ 0.22.

- Robust volume participation exceeded 43 million during fundamental breakup sessions.

- The decreased volume of the final time of 5.56 million suggests the consolidation compensated to the apex of $ 0.23.

- Two different phases characterized the final time: Initial consolidation around $ 0.23 Support happened by a decisive wave that begins at 13:37.

- The volume increased to 2.87 million during rupture, promoting the price through multiple levels of resistance, including $ 0.23 and $ 0.23.

- Hbar achieved its session zenith of $ 0.23 with a sustained volume above 1.75 million during window 13: 57-14: 06.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.