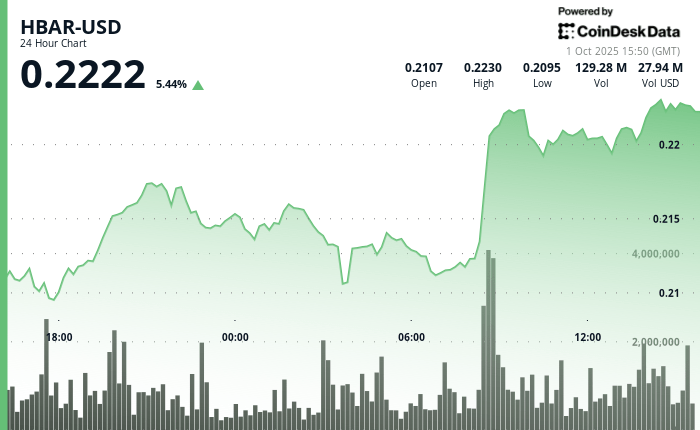

Hbar registered a strong technical performance in the last 23 -hour negotiation window, moving from $ 0.21 to $ 0.22 while registering a negotiation range of $ 0.012, equivalent to a volatility of 5.7%.

The market action was highlighted by a firm consolidation at $ 0.209 in a heavy volume before buyers pushed the token decisively above the resistance of $ 0.221 at 08:00 UTC.

The rupture, backed by more than 125 million tokens that were negotiated, established a new peak about $ 0.222, which later became a new support around the level of $ 0.22. The last time of negotiation saw another increase, with a high volume thrust of $ 0.220 to $ 0.222, which highlighted the continuous uprising impulse.

Profits occur in the midst of renewed institutional enthusiasm, with Hbar rising approximately 4% in the last 24 hours. Hedera positioning has been reinforced by high profile associations, including work with Swift, Citi and Germany’s Bundesbank on interoperability frames. In the US, Wyoming’s decision to take advantage of Hbar for its Frontier Stablcoin initiative has further reinforced credibility, placing the network at the forefront of the adoption of Blockchain at the state level.

Technically, the cryptocurrency faces a well -defined range, with support established at $ 0.21 and general resistance expenses at $ 0.23. Impulse oscillators, who had recently cooled over -sales territory, suggest that consolidation could give way to continuous ascending pressure.

The commercial activity in the most recent session showed a strong confirmation of volume in the key support and resistance areas, indicating that market participants are prepared to defend the current upward trend.

Technical Indicators Sustained Force Signal

- The consolidated support level at $ 0.209 with a substantial volume confirmation of 102.98 million during the 17:00 session.

- Decisive penetration above $ 0.221 resistance at 08:00 with an exceptional volume of 125.71 million units.

- The ascending trajectory suggests a persistent purchase pressure and a continuous potential towards the Fibonacci extension level of $ 0.223.

- Volume acceleration during the 60 -minute period with an explosive volume of 3.19 million at the outbreak of 14:04.

- The sustained purchase pressure and volume confirmation greater than 2.25 million during period 14: 05-14: 06 Validate the bullish continuation.

- Potential for a greater advance towards the Fibonacci extension level of $ 0.225 based on the current features of the current.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Complete AI of Coindesk.