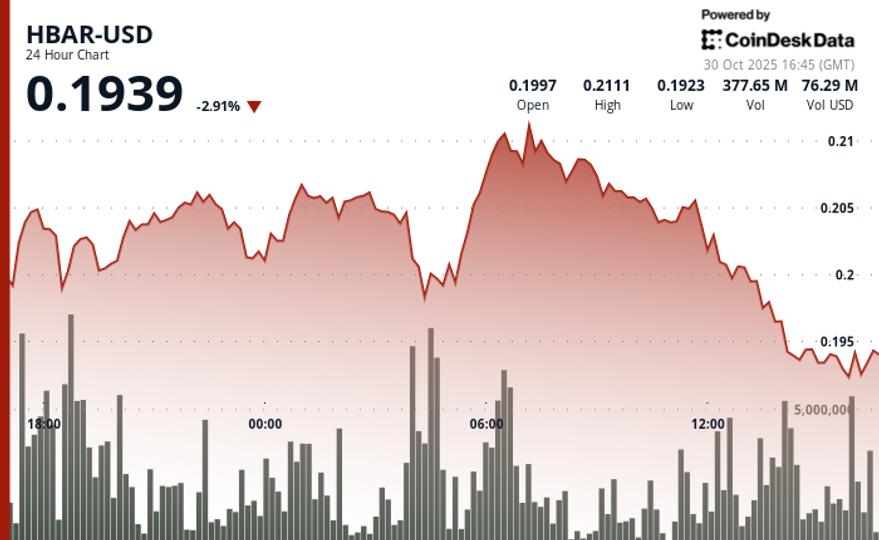

Hedera’s native token HBAR fell 3.25% to $0.1925 during the 24-hour period ending October 30, despite the launch of its first exchange-traded fund in the United States.

The sell-off followed the debut of Canary Capital’s HBAR spot ETF on the Nasdaq, a milestone for non-Bitcoin digital assets.

The token initially rallied more than 25% following the announcement, but enthusiasm quickly faded as profit-taking began. The ETF, which trades under the symbol HBR, saw around $8 million in first-day volume, underscoring strong institutional interest despite near-term price weakness.

While the ETF marked a regulatory and institutional breakthrough for Hedera, technical factors overshadowed fundamentals. HBAR broke through key support levels, confirming bearish momentum and triggering accelerated selling pressure.

Market data suggests that the drop was part of a broader pattern of controlled selling of digital assets. Elevated trading volumes, nearly 20% above normal levels, indicate that larger players may have been locking in profits from the ETF-driven rally.

Key technical levels indicate continued pressure for HBAR

Support/Resistance

- The critical support at $0.2040 was broken during the 24-hour period.

- Fresh resistance formed in the $0.2070 to $0.2080 zone after multiple rejections.

Volume analysis

- Strong selling pressure with 261.2 million tokens traded, 87% above the 24-hour average.

- The most significant volume activity occurred on October 30 at 04:00, when the price broke through key technical levels.

Chart Patterns

- Bearish trend established with successive lower highs from the $0.2114 peak.

- Total range of $0.0203 (9.9%); The price plummeted from $0.194 to $0.192 amid massive volume spikes.

Goals and risk/reward

- The 60-minute analysis indicates a further decline towards $0.190.

- Momentum indicators are showing severely oversold conditions, confirming accelerated institutional selling.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.