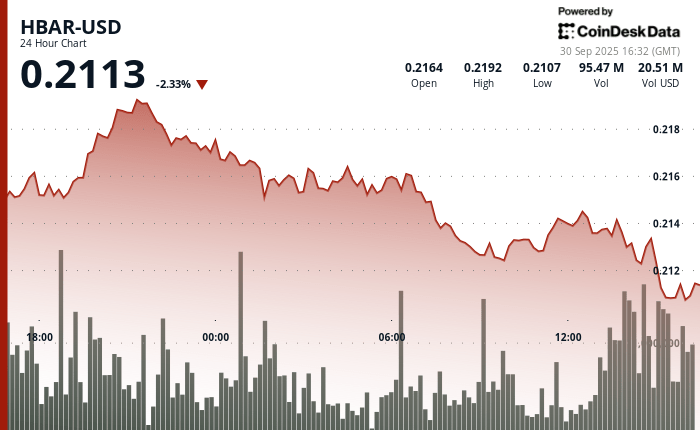

The token hbar of Hedera hashgraph fell almost 3% in 24 hours until September 30, falling from $ 0.22 to $ 0.21 as institutional investors reduced exposure to cryptocurrencies focused on the company. The decrease occurred after Hbar met with resistance at the level of $ 0.22 during the night negotiation on September 29, with volumes that rose above 34 million tokens when corporate shareholders began to obtain profits.

Market participants said that support around the threshold of $ 0.21 initially remained during the morning of September 30, but a heavy sale in the afternoon pushed at much higher volumes, reaching its maximum point in almost 55 million tokens in the last hour of negotiation. The analysts suggested that the measure reflected a growing caution among corporate treasure bonds following the evolving regulatory frameworks for the adoption of business block chain.

At the end of the afternoon of September 30, Hbar recovered briefly before sliding again to the intra -intradia around $ 0.21. High commercial activity during the final time, of 5.9 million tokens in a single interval, illuminated the intensity of the institutional rebalancing. The Token ended the session with a modest stabilization about $ 0.21, but market observers warned that continuous volatility can persist as corporate strategies adapt to winds against regulatory changes.

Market analysis

- Resistance established at $ 0.22 during September 29 Night contributions with institutional profits in the volume higher than the average.

- The support zone identified around $ 0.21- $ 0.21 with multiple corporate purchase opportunities during morning sessions.

- The volume increases to 54.88 million tokens at the final time indicating accelerated institutional risk management protocols.

- Extraordinary commercial activity that reaches 5.90 million tokens during the interval of 3:10 pm and 4.51 million at 3:11 pm.

- Rest below the established support zone that suggests a continuous potential for corporate elimination in the business blockchain sector.

- Price stabilization efforts near the level of $ 0.21 per final session with sustained institutional trade volumes.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.