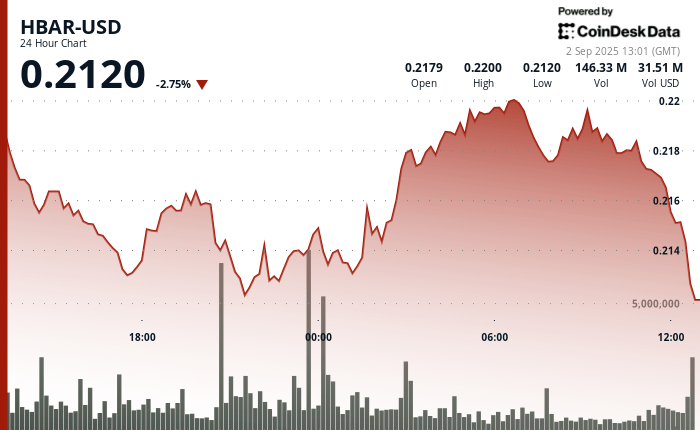

Hbar saw greater volatility during the 24 -hour period from September 1, 09:00 to September 2, 08:00, quoting within a range of $ 0.013 that marked an intradic and 6% swing between $ 0.21 and $ 0.22.

The token initially fell from $ 0.22 down to support $ 0.21, heavy due to an increase in liquidation volumes that increased above 79 million. However, as the sales pressure decreased, Hbar increased a recovery, closing the session near the level of $ 0.22.

The market activity suggested that the bassist impulse lost steam once the level of $ 0.21 was tested, with decline volumes in the rebound that indicates a potential change towards a sustained ascending impulse.

Commercial action underlines a short -term technical structure where resilience at key support levels has kept the bullish perspectives intact.

The emphasis on real world applications is to position Hedera and other blockchains centered on the company at the forefront of investor attention. Together with Hedera, projects such as Kaspa and Remittix are generating impulse by directing scalability and cross -border payments, respectively.

With the innovation of the payments that resurfaced as the engine of adoption of cryptography, corporate alliances and the technological architecture of Hedera they put it in a solid position to benefit from the market’s turn towards the blockchain infrastructure promoted by public services.

Evaluation of technical indicators

- Negotiation bandwidth of $ 0.013 representing 6 % differential from the $ 0.21 session to APEX of $ 0.22.

- The volume increases greater than 79 million during the initial decrease phase.

- Critical support threshold examined about $ 0.21 before recovery.

- Decreasing liquidation pressure to conclude negotiation hours.

- The recovery impulse raises prices towards the resistance of $ 0.22.

- Exhaustion of the bearish impulse indicated by volume patterns.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.