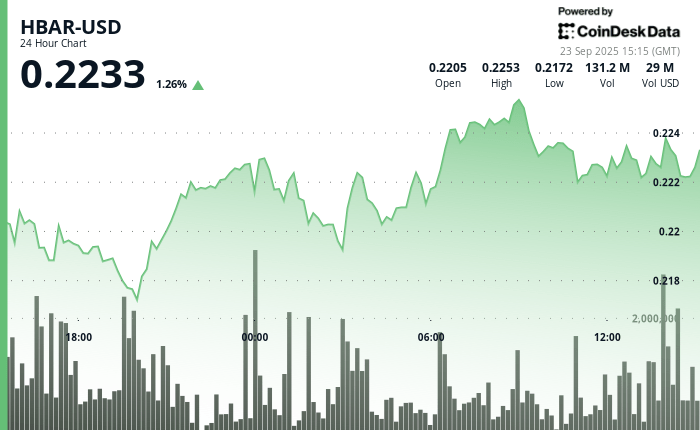

Hbar saw a 23 -hour stretch volatile between September 22 at 3:00 p.m. and September 23 at 2:00 p.m., with the Token operating in a narrow band between $ 0.217129 and $ 0.225507. The session was opened with a strong price sale that dragged prices at $ 0.217408 before a large purchase activity restored the impulse.

That rebound was reinforced by strong support at the level of $ 0.217129, as the negotiation volume increased. Bulls then brought prices to a peak just $ 0.225507, although the resistance arose about $ 0.224358, limiting more upwards. At the end of the session, Hbar closed at $ 0.222759, marking a recovery of 2.5% of intra -dialy minimums and establishing a position above the mid -range point, which indicates a bullish bias that is directed to the next phase of commerce.

The last hour of the session added another layer of optimism. Hbar registered a modest profit of 0.06% in the 60 -minute window window ended on September 23 at 14:08, quoting within a range of 0.40% restricted between $ 0.2221 and $ 0.2230. That narrow band reflected the consolidation but also demonstrated an underlying force, since prices remained consistently above the midpoint levels of the session.

During this time, the volume peaks highlighted the intensity of market activity. A rupture at 13:27 promoted the billing at 881,924 tokens, followed by an exceptional increase to 1.58 million tokens just before 14:00. These participation explosions helped reinforce support at $ 0.2221, while $ 0.2230 limited immediate rise efforts. Despite the limited range, the sustained demand suggested accumulation instead of exhaustion.

In general, the latest session performance extended the recovery trend of 23 hours broader Hbar. The bulls maintained control, with firm intact support levels and prices were closed near the upper end of the range. The constant supply tone indicates a continuous impulse to the next session, keeping market participants by monitoring a possible rupture above short -term resistance.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.