The native hedera tab, Hbar, showed signs of bullish impulse in the last 24 hours, winning 3% while intensifying moderate market turbulence.

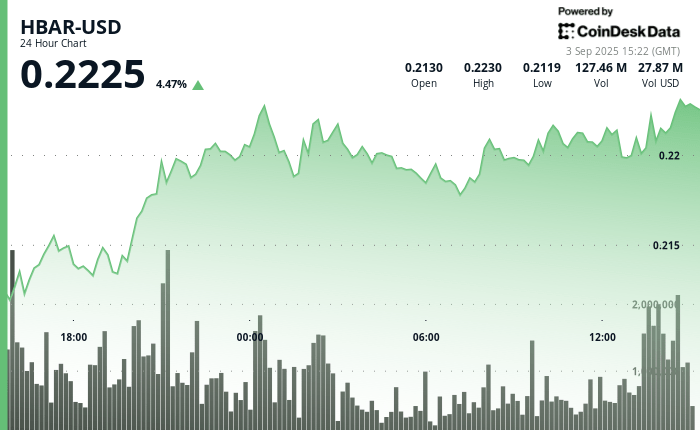

Between September 2 at 3:00 p.m. and September 3 at 2:00 p.m., the digital asset advanced from $ 0.22 to end near Session Peaks, with its negotiation range that covers 5% of the minimum of the period.

The measure occurred when the purchase activity constantly supported the token at higher levels, indicating resilience in a volatile environment.

The dynamics of trade stressed this force, with a volume increasing to 69.68 million, well above the average of 24 hours of 37.42 million.

Institutional accumulation and extraordinary explosions of activity, including a single peak of 4.87 million, highlighted the aggressive position above the key resistance thresholds.

In a shorter time horizon, Hbar registered a notable intradic volatility. In the hour between 13:29 and 14:28 of September 3, the Token recovered from $ 0.22 to a higher session before stabilizing, reflecting classic break patterns with minimal ascending and persistent impulse.

With support that is maintained above $ 0.22, merchants will observe closely to see if Hbar can maintain their upward posture in the next negotiation period.

Technical indicators Continuous force signal

- Hbar formed a solid support at $ 0.21 during the opening sessions with a substantial volume of 69.68 million, significantly exceeding the 24 -hour average of 37.42 million.

- Critical resistance materialized at $ 0.22, repeatedly challenged during night periods with amplified volume, indicating a potential development of rupture.

- The market structure showed a textbook accumulation formation with a low upward configuration.

- Volume explosions during bullish movements at 20:00 and 21:00 on September 2 validated validated purchase impulse instead of speculative activity.

- Exceptional volume bursts that reach 4.87 million at 13:43 institutional positioning confirmed above the fundamental resistance threshold of $ 0.22.

- The cryptocurrency showed a dynamic of classical rupture with a low ascending structure and a sustained purchase pressure during the ascending phases.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.