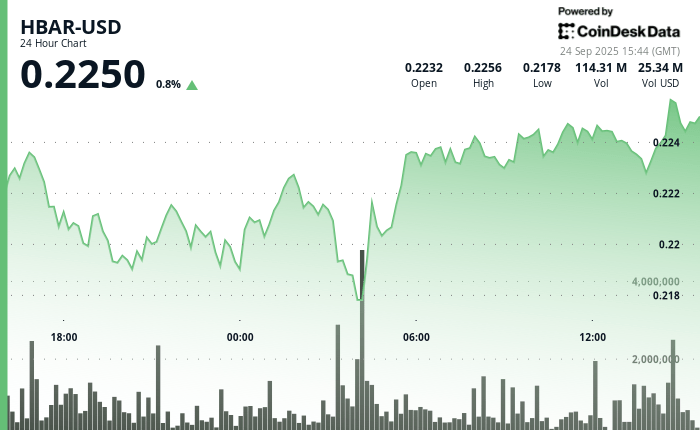

Hbar quoted with strong volatility on a 23 -hour window from September 23 to 24, winning only 0.90% despite the wide intradic swings. The Token ranged between $ 0.217 and $ 0.225, with the critical session of 04:00 on September 24 marking a strong fall at $ 0.217 before a strong rebound. That area now acts as support, while $ 0.225 remains a firm resistance.

Commercial volumes suggest that institutional players intervened during the sale of the sale. The billing reached 97.05 million at 04:00, well above the average of 37.89 million, indicating accumulation at lower levels. Later, the sales pressure returned, with Hbar falling from $ 0.224 to $ 0.223 at the final time of negotiation in almost triple volume the standard.

The volatility occurred together with an important development: the presentation of Canary Capital for an ETF Hbar Spot with an expense index of 1.95%. Analysts say that the movement underlines the institutional recognition of Halera hashgraph technology and could support long -term growth, with an objective price of $ 0.50 by 2025–2026 and $ 1.60 or more by 2030.

In the short term, the Hbar yield depends on whether supporting $ 0.217– $ 0.218 remains and if institutional demand continues to compensate for the sale pressure around $ 0.225.

Technical indicators highlight support levels

- Support area established at $ 0.217- $ 0.218 during the minimums of the session

- Resistance roof form about $ 0.225 during the negotiation period

- Volume explosion at 97.05 million at 04:00 confirms the institutional purchase

- $ 0.007 The negotiation range represents a 3.22% volatility in the 23 -hour window

- The volume of the final time triples to 1.79 million, signaling distribution pressure

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.