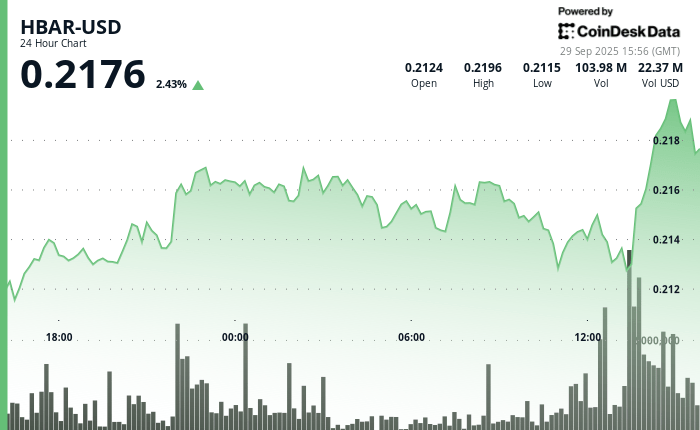

Hbar showed a remarkable resilience in the last 24 -hour negotiation window, oscillating within a narrow range of $ 0.2104 to $ 0.2172. The most significant movement arose late on September 28, when the Token increased from $ 0.2139 to $ 0.2168 by almost double volume of the daily average. This strong increase established a clear resistance about $ 0.2172, since commercial activity increased to 59.92 million tokens, which underlines the largest market share.

After this ascent, Hbar entered a phase of consolidation, stabilizing between $ 0.2144 and $ 0.2168 before retiring at $ 0.2131 for noon on September 29. The asset found reliable support at that level, which subsequently recovered at $ 0.2160, highlighting the constant demand. The activity of the late session saw another bullish explosion, with prices rising from $ 0.2132 to $ 0.2164 in one hour, backed by strong volume flows that reinforced the impulse.

The rally comes in a context of greater uncertainty in the market, where digital assets such as Hbar have attracted institutional attention. Investors continue to gravitate towards Blockchain infrastructure projects, such as Hedera, as potential hedges amid volatility in traditional financial markets.

Technical indicators underline the characteristics of bullish impulse

- Hbar exhibited a considerable uphill during the previous period 24 hours from September 28 from 3:00 p.m. September 29, 14:00, moving from $ 0.21 to $ 0.22 that represents an appreciation of 2.37%.

- The general negotiation range covered $ 0.01 (2.78%) between the absolute minimum of $ 0.21 and the maximum of $ 0.22.

- The remarkable volume increases during critical progress periods at 10:00 p.m. and 1:00 p.m. reinforced the upstructed ascending trajectory despite the periodic consolidation phases.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.