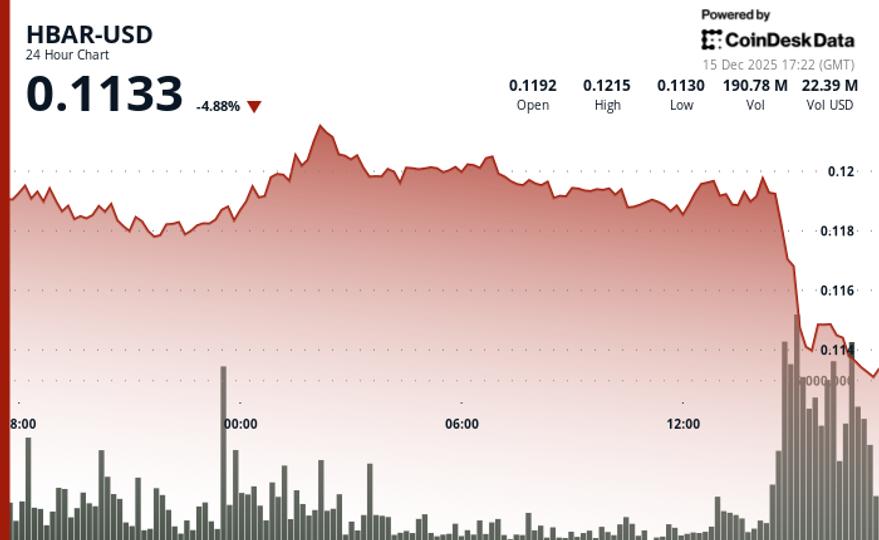

Hedera crashed through key support levels during the session on Sunday, falling 5.8% from $0.1202 to $0.1127, as technical selling pressure outweighed initial buying interest.

The cryptocurrency established a clear bearish structure after failing to sustain gains above $0.1218, with the price action dominated by profit-taking near resistance levels.

Volume patterns told the story of capital flows throughout the session. Trading activity soared to 69.18 million tokens on December 14 at 20:00 UTC, marking an 86% rise above the 24-hour average of 32.8 million tokens, as HBAR tested critical resistance near $0.1194.

The rejection triggered a cascade of selling that pushed prices through established support levels, and subsequent sessions showed a decline in volume that signaled lower institutional participation.

As institutional flows fueled both the initial sell-off and late-session rally, technical resistance levels at $0.1194 became the critical battleground for HBAR’s near-term direction.

Aside from a momentary spike during the October sell-off event, HBAR is now trading at its lowest point since November 2024.

Key technical levels indicate mixed outlook for HBAR

Support/Resistance: Critical resistance remains at $0.1194 following a high volume rejection, with new support established at $0.1121 following the late session reversal. The deepest support remains at $0.11.

Volume analysis: The peak volume of 69.18 million tokens validated the integrity of the resistance level, while the 750% volume increase at the close of the session indicated renewed institutional interest after a period of declining participation.

Chart Patterns: The descending trend line from the high of $0.1218 was broken, although the price remains within the established consolidation range between $0.1129 and $0.1193 formed during the session.

Objectives and risk/reward: A break above the $0.1194 resistance targets the previous high near $0.1218, offering upside potential, while failure to hold the $0.1121 support risks a retest of the $0.11 level.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.