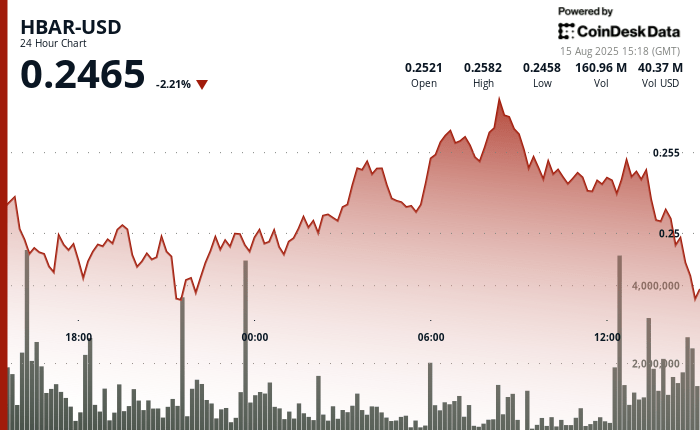

Hbar registered strong price changes during the 24 hours between August 14 at 3:00 p.m. and August 15 at 2:00 p.m., moving within a range of $ 0.015, a 6% gap between the maximum day of $ 0.259 and minimum of $ 0.244.

The Token faced a strong sales pressure at the beginning of the session, playing at $ 0.244 around 9:00 p.m. on August 14 before organizing a strong rebound at $ 0.259 at 08:00 in the next morning.

Commercial volumes reached 65.56 million during recovery, well above the average of 24 hours, which underlines a strong participation.

The key support was formed between $ 0.248 and $ 0.249, where buyers intervened repeatedly.

On the positive side, the resistance solidified at $ 0.255– $ 0.256 as sellers intensified the distribution. The increase in the minimum during the night showed a solid moment with the backing of the volume, insinuating the systematic accumulation.

However, the setback after $ 0.251 reflected the profits near the resistance and pointed out the possible short -term consolidation.

Mercado broader market feeling to volatility. Grayscale requested the Trust Delaware records for Potentials ETF HBAR and Cardano Spot, using a family structure of previous cryptographic investment products.

Meanwhile, Binance expanded the functionality of the BNB smart chain to include HBAR and SUI, which allows more efficient cross -chain transactions and increasing retail accessibility. These developments indicated the strengthening of institutional interest even when short -term price action hesitated.

Synopsis of technical indicators

- Negotiation range of $ 0.015 representing the 6% differential between $ 0.259 peak and $ 0.244 channels during the 24 -hour period.

- Critical support threshold established at $ 0.248- $ 0.249 where purchasing interests arose systematically.

- The resistance zone materialized around $ 0.255- $ 0.256 where the distribution pressure intensified substantially.

- The volume increased to 65.56 million during the reach of recovery to $ 0.259 significantly exceeded the 24 -hour mobile average.

- Displosed below the $ 0.252 support confirmed by a high volume greater than 5 million during the final negotiation time.

- Obvious institutional distribution pattern for 13: 35-13: 45 Time frame with acute prices.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.