Bitcoin Miner Riot Platforms (Riot) on Tuesday reported a strong production growth in May, undermining 514 BTC, an increase of 11% since April and a jump of 139% compared to the level of the previous year. The company sold almost all Bitcoin, generating $ 51.3 million in revenues at an average price of $ 102,591 per Token.

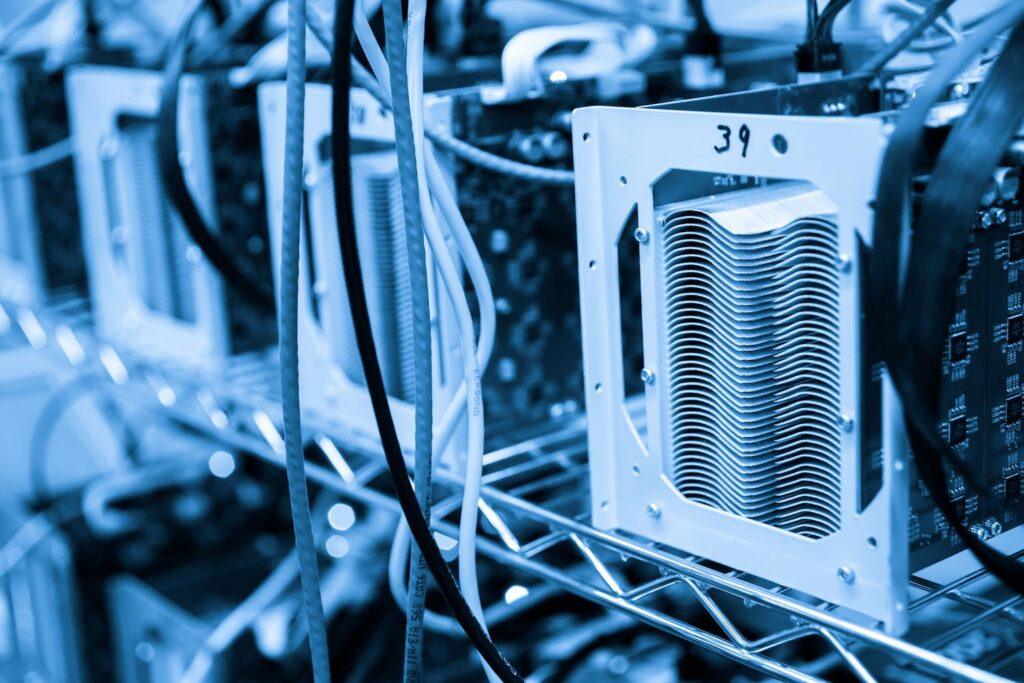

Riot’s hashrate also rose, with a total implemented computer power that reaches 35.4 exahasos per second, an increase of 5% over April and 142% higher than the previous year. Operational efficiency also improved, with the fleet running at 21.2 joules by Terahash, below last May 28 J/th last.

Beyond mining, Riot is positioning for growth in AI and high -performance computing sectors (HPC). In May, the company closed the acquisition of 355 acres of land near its Corsican facilities in Texas. The Jason CEO told them that the site will support the development of data centers adapted to business clients and hyperscale, noting that these centers require significantly higher footprints than traditional mining operations.

To lead this effort, Riot hired the veteran of the Jonathan Gibbs industry as head of the data center officer. The movement indicates Riot’s ambition to diversify beyond Bitcoin and in the rapid growth market for infrastructure ready for AI.

Riot’s shares are higher by 3.4% in Tuesday’s negotiation.