- ‘Gamified job scams’ have increased by 485% in the last year

- These ask job seekers to complete online tasks for small payments

- This represents a loss of more than $6.8 million in 2025.

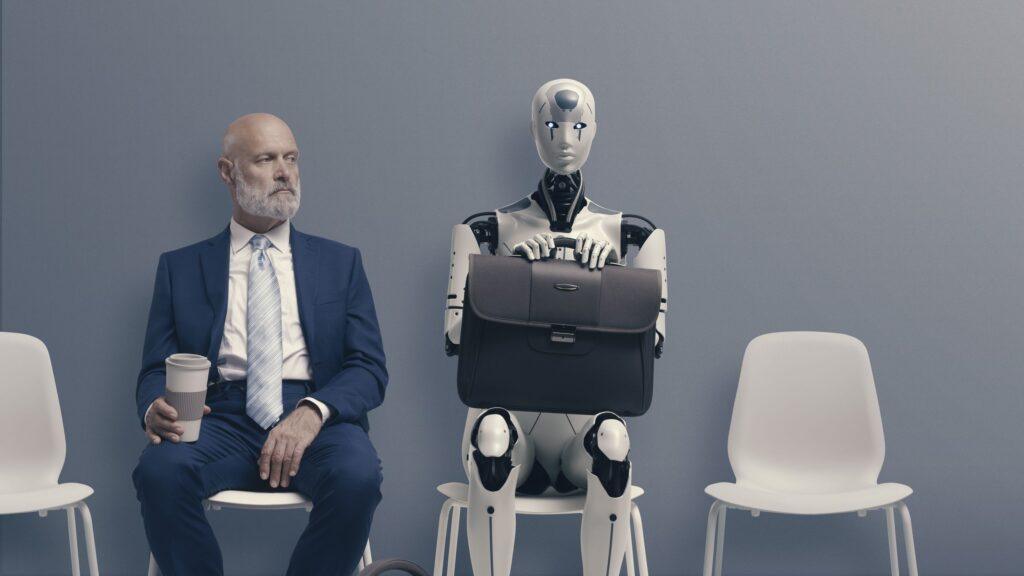

New research from CNC Intelligence has revealed a huge increase in the number of “task scams” or “gamified job scams” targeting job seekers in 2025.

Almost everyone will be aware of the increasingly difficult job market, with more than 7.5 million Americans currently unemployed. That has opened the door for scammers to take advantage of those seeking new opportunities.

The ‘assignment scam’ begins, as you may have guessed, with an assignment. Usually it involves liking a video, commenting on a product, or leaving a review. From there, scammers will build trust with a small payment, often through cryptocurrency, but that’s where the generosity ends.

Growing demands

This is where it starts to get serious. Targets are then encouraged to deposit cryptocurrency into an account to then complete other tasks, but of course this never happens.

Withdrawals are blocked and “trusted” contacts within the scheme will persuade victims to continue depositing more funds to “unlock” more profits. These profits never materialize and the victims suffer huge losses.

In fact, research has identified a total loss of $6.8 million from this type of scam in 2025, which represents a year-on-year increase of 485%.

That’s a total of 4,757 reports of homework scams, almost six times more than the 813 seen in 2024.

“Homework scams are designed to drag victims into a cycle that becomes harder to escape the longer it lasts,” explains Matthew Stern, CEO of CNC Intelligence.

“The first few tasks may seem legitimate, but as soon as the pressured requests for money start, it’s a strong sign that something isn’t right. No real employer will ever ask you to pay to access your own earnings. Other early clues include payment terms that seem unusually generous, or that all communication is done via WhatsApp or Telegram.”

The job market is incredibly tough right now, making it even more important to be careful with your savings.

The main thing to remember is that, just like your bank won’t call you to ask for your details, legitimate job offers won’t ask for your details. you pay them when you complete jobs for them, especially not with cryptocurrency.

The best identity theft protection for every budget