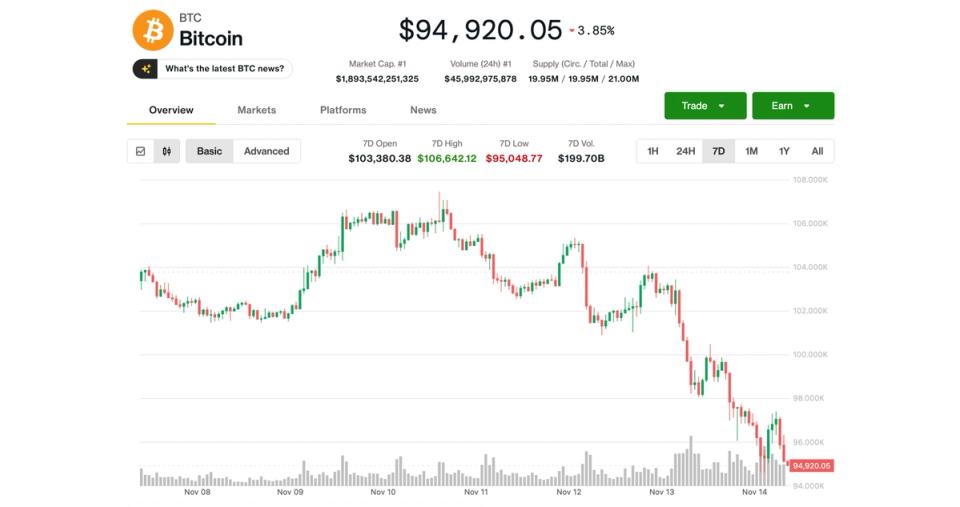

bitcoin saw no rebound on Friday, holding at session lows below $95,000 at the end of the day in the US after a tough week that dragged prices to their lowest level since May.

The largest cryptocurrency is once again underperforming US stocks, with major US indices maintaining smaller gains a few minutes before the end of trading. BTC was on track to post a 9% loss for the week, its best performance in eight months.

Ethereum trading below $3200, fared worse, falling more than 11% since Monday, while Solana’s SOL lost 15% during the same period. held up better, falling just 1%, perhaps boosted by the debut this week of its first U.S. spot ETF, issued by Canary Capital.

Cryptocurrency-related stocks had a mixed performance after Thursday’s sharp losses. MicroStrategy (MSTR), the largest public holder of bitcoin, fell another 4% to fall below $200 for the first time since October 2024. Exchange Bullish (BLSH), Ethereum treasury BitMine (BMNR), miners CleanSpark (CLSK), MARA Holdings (MARA), and Hive Digital (HIVE) fell between 4% and 7%.

On the positive side, miner Hut 8 rebounded 6% following earnings results from American Bitcoin, a joint venture with the Trump family, while digital brokerage Robinhood (HOOD) and BTC miner Riot Platforms (RIOT) advanced about 3%.

The ‘information vacuum’ clouds investor confidence

The current market slowdown is largely due to a lack of clarity over key US economic conditions and the subsequent direction of monetary policy, Bitfinex analysts said. That data blackout was due to the longest government shutdown in the United States, which lasted from Oct. 1 to Thursday, and which suspended the release of government data on inflation and employment.

“The market pullback is the result of an information vacuum and political uncertainty,” they wrote in a Friday note shared with CoinDesk. “Key economic data is still missing to guide the market and the Federal Reserve, putting investors on alert.

However, the shutdown-ending spending bill that lawmakers approved only provides funds to keep the government open through Jan. 30, weighing on investor confidence. “The temporary funding bill does not resolve the uncertainty; it simply delays the problem.” Bitfinex analysts added.

Noelle Acheson, author of Crypto Is Macro Now, said the recent drop was a necessary correction after months of consolidation within a range that failed to sustain a break above $120,000. “We need to get over this blush before we can breathe easier,” he wrote. “Once that happens, the long-term case for BTC becomes stronger, but we’re not there yet.”

The main driver of BTC remains macro liquidity, Acheson added. While another Fed rate cut may not come until later in the first quarter of 2026, expectations of balance sheet adjustments or other easing measures and “liquidity injections” could help rebuild optimism around risk assets, including BTC, he said.

BTC heading to $84K, says Ledn CIO

Meanwhile, technical indicators suggest that Bitcoin may still have plenty of room to fall, said John Glover, chief investment officer at crypto lending firm Ledn.

He noted that a break below the 23.6% Fibonacci retracement level, just below $100,000, opened the way to the next key support level, situated around $84,000.

Glover believes the current pullback is part of bitcoin’s bear market and predicts volatile action in the coming months. “We will likely see prices back above $100,000 before any sustained break below $90,000,” he said, noting that the full correction could play out until summer 2026.