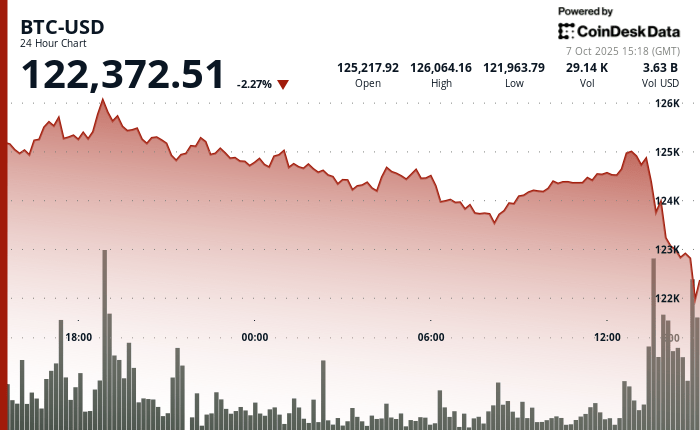

The Crypto rally paused on Tuesday with Bitcoin Quickly withdrawing from the maximum records greater than $ 126,000 when analysts pointed out the signs of corypto rally overheating, at least in the short term.

BTC fell below $ 122,000, erasing the last three days of profits and quoting 2.4% lower in 24 hours. The sale of the sale undoubted throughout the encryption market, with , , and Less than 5% -7% during the period.

If the price action in Bitcoin seems familiar, it is because it is. Despite a gain of 31% to date, Bitcoin has given the bulls very few chances of enjoying their victories. Apparently, each record has encountered a quick and viscous mass sale. Consider the first race at $ 109,000 just before the inauguration of Trump in January. That was reversed lower than $ 100,000 in hours and $ 75,000 in three months.

The first July movement above $ 123,000 was fulfilled with a decrease of approximately 10% in the following days. And a similar wave above $ 120,000 in mid -August foresaw around a 15% drop in the following days.

The decrease of this time occurred after the almost vertical Bitcoin pump of 16% of the bass of the end of September below $ 109,000.

Jean-David Péquignot, CCO of Marketplace Deribit options, projected in a Monday report that BTC could visit the $ 118,000- $ 120,000 area shaking the merchants who lost the minimums and joined the late rally. If that setback occurs, he said, he would offer a purchase opportunity as technicians and the macro environment aligns so that BTC exceeds $ 130,000 to the last quarter of the year.

The derivative market and ETF tickets also overheated, said Vetle Lunde, head of research at K33. He pointed out that last week he marked the accumulation of the strongest BTC of the year, with a combined 63,083 BTC (with a value of approximately $ .7 7 billion) in ETF, CME and perpetual future of the USA. UU., Assuming the May peak. The increase was driven by a long generalized position that bets at higher prices without a clear macro catalyst, sitting the ground for a setback.

“Historically, similar bursts in exposure have often coincided with local tops, and the current configuration suggests an overheated temporal market with a high risk of short -term consolidation,” Lunde said.

They look at Fed says that the neutral rate should be 0.5%

The governor of the Federal Reserve, Stephen Miran, a recently designated Trump, said on Tuesday that his vision of the neutral interest rate has changed “from one end of the range to the other”, during a discussion in the policy of the Association of Funds Managed Outlook 2025. He now believes that the neutral rate should be 0.5%. Miran pointed out the strictest immigration restrictions and the expectations evolved on the federal deficit as the main factors behind their reassessment.

Miran’s comments suggest that the long -term forces that shape the US economy are changing. A smaller labor group could limit growth, while the increase in fiscal pressures could maintain the act of balance of the Fed between inflation and the most complex employment. Their comments occur when policy formulators debate how much space the Central Bank has to reduce rates without rekindling price pressures.

Fed officials meet at the end of this month to decide on a possible cutting cuts, however, without critical data from the government as the closure continues.

Mira also pointed out that economic growth in the first half of the year was weaker than expected, overwhelmed by uncertainty about trade and fiscal policy. But Look gave a more positive tone for the coming months, saying that much of that uncertainty has now been cleared. “With clearer policy signs, I expect a more stable growth rate,” he said.

Cryptography stocks suffer

The broad setback in cryptographic prices is reaching related actions, led by a 7% decrease in the strategy (MSTR) and a 4% loss for Coinbase (COIN). Ether Treasury Bitmine Immersion (BMNR) and Sharplink Gaming (SBET) treasures have dropped 3% and 7%, respectively.

Bitcoin miners are mainly in red, led by Mara Holdings that fall 4% and riot platforms (Riot) 3%. HUT 8 (HUT) is lower by 2%.