Cabaña 8 (CABIN)A public bitcoin The mining and energy infrastructure firm increased on Tuesday after revealing plans for more than twice the company’s energy capacity.

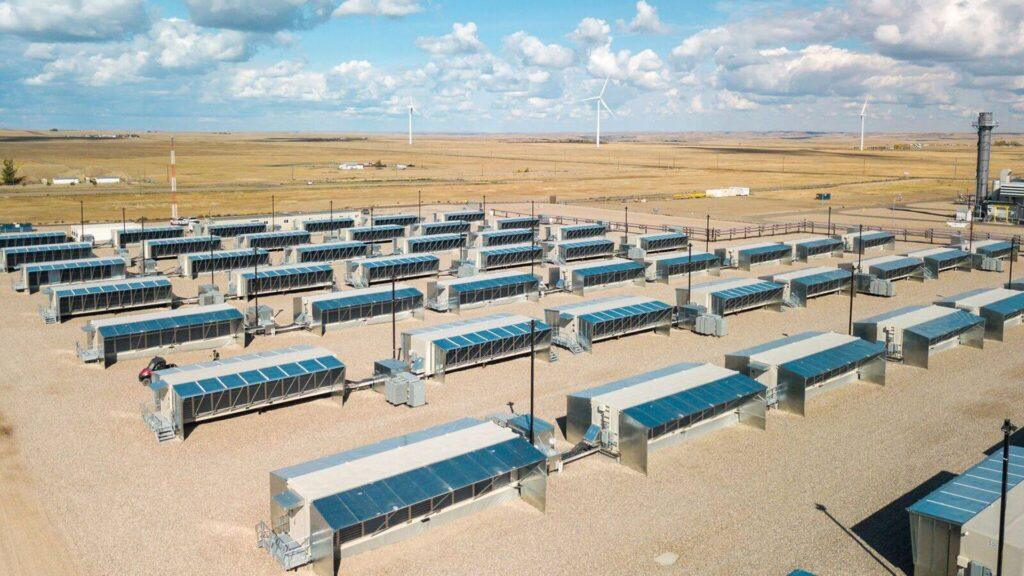

The plans include the development of four new sites in the United States with more than 1.5 gigawatts (GW)Expanding the total power capacity to more than $ 2.5 GW in 19 locations, according to a press release.

The action increased more than 10%, reaching a maximum of seven months just $ 26 per share, even when Bitcoin prices remain stuck in the crisis below $ 110,000.

Data centers enjoy a renewed interest of investors as the demand for computer energy rises to feed artificial intelligence innovation. Recently, the technological giant Google took a minority participation in the miner of Bitcoin Terawulf as part of an AI infrastructure agreement of $ 3.2 billion.

“This expansion marks a defining step in the evolution of Hut 8 on one of the largest digital and energy infrastructure platforms,” said the CEO of Hut 8, Asher Genoot, in the press release.

The company said that it has reclassified the “exclusivity to” development “projects, which means that it has secured land and energy agreements and is working in design and marketing.

To finance the projects, the company plans to collect up to $$ 2.4 billion in liquidity from several sources. This includes loans against its 10,000 BTC stash for a value of approximately $ 1.1 billion, a $ 200 million rotating credit line, an expanded installation of $ 130 million coinbase and a capital offer in the recently launched market.

The Roth Capital Investment Bank saw the expansion plans as a “notable step”, with the potential to “re -qualify the shares” as the sites enter line and contract for AI and high performance computing.

Read more: Bitcoin Mining faces the ‘incredibly difficult’ market as power becomes the true currency