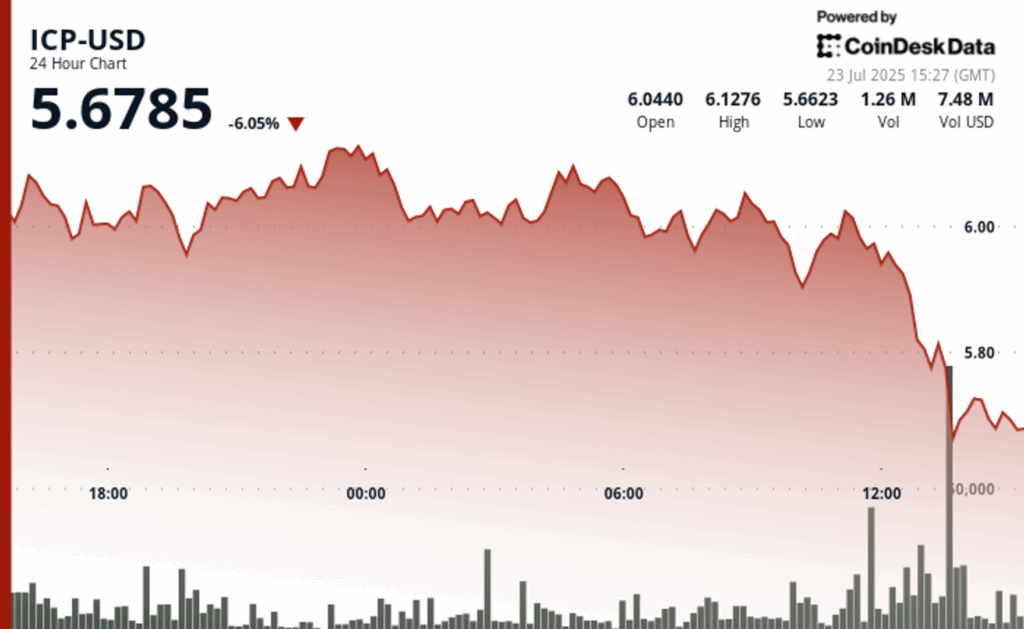

Internet Computer (ICP) registered a 5.35% setback in the last 24 hours, falling from $ 6.01 to $ 5.69 as a weak weakness between the broader Altcoin market. ICP struggled to maintain a bullish impulse, finding firm resistance in the $ 6.00– $ 6.10 zone that had limited multiple rupture attempts.

The most acute decrease occurred during the 1:00 p.m. UTC on Thursday, when ICP reduced to $ 5.62 from $ 5.97 in just a few minutes, conducted by a huge increase in the negotiation volume. The total daily billing reached 2.58 million tokens, almost four times the average of 24 hours, which underline the distribution pressure at an institutional scale, according to the technical analysis data model of Cindensk Research.

The broader market showed a similar dynamic, with Altcoins such as Sol, Avax and adapting in the midst of the profits and regulatory developments. The analysts characterized the recoil as a healthy rotation after the demonstrations related to President Donald Trump and renewed attention to Stablecoin’s legislation. Despite the individual uprisers, many tokens could not maintain upward traction, with merchants reasignating capital and defending the key support areas.

Technical analysis

- ICP fell 5.35% of $ 6.01 to $ 5.69 between July 22 and 23.

- A maximum intradic of $ 6.14 and minimum of $ 5.62 established a volatile range of $ 0.52 (8.4% extension).

- Price fell to $ 5.62 of $ 5.97 at 1:00 p.m. UTC on July 23, in the volume of Timles of 2.58 million.

- The volume during capitulation exceeded 100k per minute, almost 4 × daily average of 650k.

- Confirmed resistance at $ 6.00– $ 6.10 with multiple attempts of failed rupture.

- Critical support was formed at $ 5.62 after a large sale for 13: 40–13: 51 UTC window.

- Market had trouble claiming $ 5.83, with a persistent sale in minor rebounds.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.