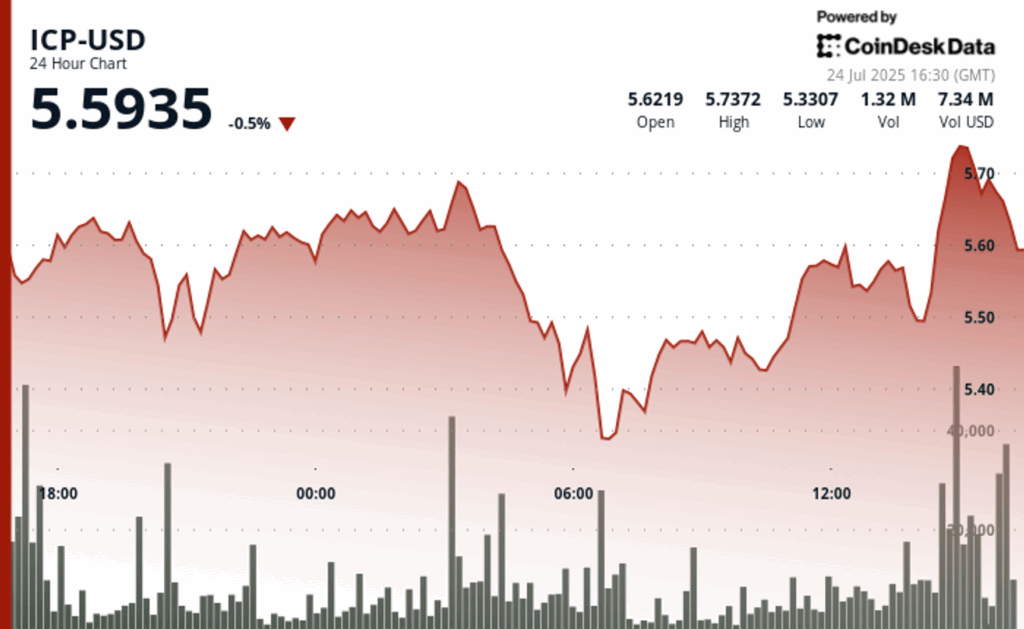

Internet Computer (ICP) experienced an acute investment after climbing at $ 5.76, with the token falling to $ 5.59 under a renewed bearish pressure.

The movement limited a 24 -hour volatile window in which prices balancing between $ 5.28 and $ 5.76, a range of 8.3%, according to the Coindesk Techincal analysis data model. Bulls briefly pushed prices to the upper end of the corridor before Bears reaffirmed the control, sending the lowest prices in the increase in volume.

The heavy sale arose after the price touched $ 5.76, with a slide of 42 minutes at $ 5.66 forming a remarkable rejection. The volume increased earlier in the day, with an ascending movement of $ 5.28 to $ 5.72 driven by 897,725 tokens negotiated, well above the daily average. Despite the demonstration, the impulse faded quickly once the resistance was tested again.

While the price action showed a clear technical rejection near the upper limits, the Internet computer remains fundamentally strong. ICP leads all block chains in Github’s development activity, surpassing Chainlink and Filecoin, Santiment said in his last monthly classification.

The development of the ICP development underlines the persistent growth of the ecosystem and the commitment of the team, even when market participants seem doubts to pursue recent pricing. Analysts point out the confluence of technical resistance and a broader and more cautious market such as retirement drivers.

Technical analysis

- Price range: It was balanced between $ 5.28 and $ 5.76, an intradic differential of 8.3%.

- Resistance: $ 5.76 limited up with visible rejection.

- Support: strong support confirmed in $ 5.28 amid early accumulation.

- Pico volume: 897,725 tokens negotiated during the rebound from the minimum intradia.

- Wind sale window: decreased from $ 5.76 to $ 5.66 between 15: 08–15: 50 UTC.

- Short -term support: $ 5.66 emerged as an apartment after the bearish movement.

- Commercial activity: The final minutes vanished the volume of trade, the pause of signaling.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.