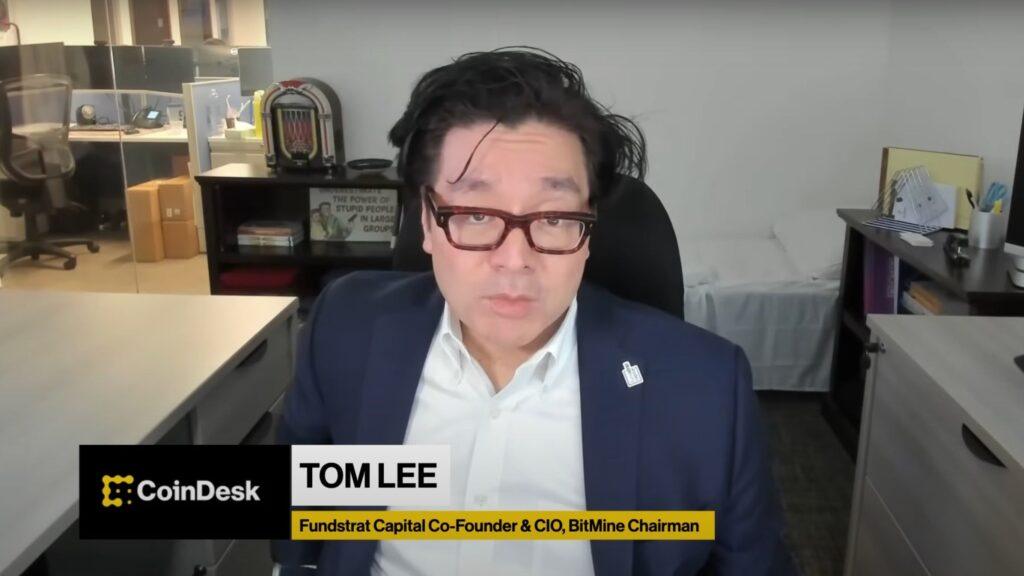

Cryptographic markets may be rising, but some investors do not believe that the demonstration is real, and that is why it could be much higher, according to Tom Lee, co -founder of Fundstrat and president of the Treasury firm of Ethereum, Bitmine Immersion, (BMNR).

Talking to Coindesktv, Lee explained why he called the rebound through cryptography and actions that began in April “the most hated V -shaped rebound in history.”

This is because when the markets collapsed after the tariff announcements of President Donald Trump at the beginning of the month, economists predicted a recession, and many investors remained away from more risky assets. The rebound caught them off guard.

“Since 2020, investors have underestimated each recovery,” he said. “This is no different.”

Traditional financing is increasingly buying in crypto, constantly and silently, said Lee. The ethereum block chain ether (Eth)He said, it is benefiting from the impulse of Wall Street to tokenization, choosing the network for its legal clarity and technical reliability. “Ethereum has never had inactivity time. That is important for banks,” he said.

Lee’s company, Bitmine, is betting on that.

Currently, the company owns 625,000 ETH and almost $ 2.8 billion in assets, practically without debt. Lee also confirmed a repurchase of shares of $ 1 billion, while reaffirming the company’s objective to accumulate 5% of the ETH supply.

Bitcoin

Meanwhile, it is becoming a recurring purchase for institutional investors. Lee said he believes that a change in the Federal Reserve policy, particularly a movement of feat cuts in the coming months, could send BTC to $ 250,000.

Lee Valora ETH, currently with a price of $ 3,700, at $ 15,000 according to the foundations of the network. It maintains that real history is an institutional adoption underestimated.

“We are not at the top,” he said. “We are in the middle of the cycle.”