- .TWII could reach 30,000 points in 2026 after 22% growth so far this year

- TSMC Shares Are Up 39% YTD and Largely Unaffected by AI Chip Bias

- Experts warn that many portfolios are still too reliant on AI

Investors appear undaunted by threats of an “AI bubble” in Taiwan, as the benchmark index (.TWII) approaches 30,000 points in 2026, and the market value has doubled in the past three years.

Analysts generally agree that Taiwan is in a win-win position when it comes to AI, because it supplies many of the critical components associated with the AI architecture.

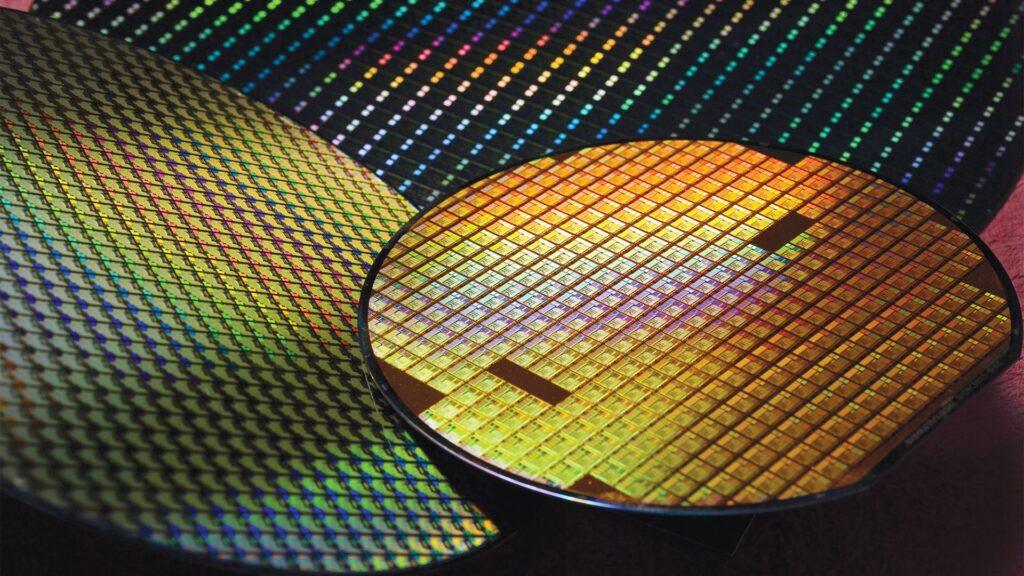

For example, Taiwan Semiconductor Manufacturing Company (TSMC) benefits regardless of whether the world favors Nvidia GPUs, Google TPUs, or other alternatives.

Taiwan could be at the forefront of the AI wave

TSMC shares are up 187% in five years and 39% so far this year. Sector valuations are also generally considered reasonable, with the Taiwan market’s P/E of around 21, which is below the Nasdaq and Nikkei. Ultimately, this healthy figure goes a long way toward easing concerns about an AI bubble.

The growth of AI and cloud is also far from over, and hyperscalers like Amazon, Google and Microsoft are set to spend more in the coming years, boosting Taiwanese manufacturing.

Despite international concern about an AI bubble, local sentiment remains positive (Taiwan stocks are up about 22% so far this year), in line with the Nasdaq. Still, foreign investors have shed about C$533.8 billion in 2025 due to trade uncertainty, AI risk concerns and profit-taking, per year. PakGazette information.

And things seem unlikely to change in the foreseeable future, as Taiwan’s winning formula (largely created by TSMC’s influence) is difficult to replicate.

Still, even if Taiwan has eased some concerns about a looming AI bubble, strategists warn that Asian portfolios are too concentrated on AI trades, particularly TSMC, which would amplify the effects of any market fluctuations.

Follow TechRadar on Google News and add us as a preferred source to receive news, reviews and opinions from our experts in your feeds. Be sure to click the Follow button!

And of course you can also follow TechRadar on TikTok for news, reviews, unboxings in video form and receive regular updates from us on WhatsApp also.