The bitcoin treasury stock bloodbath may have finally bottomed out.

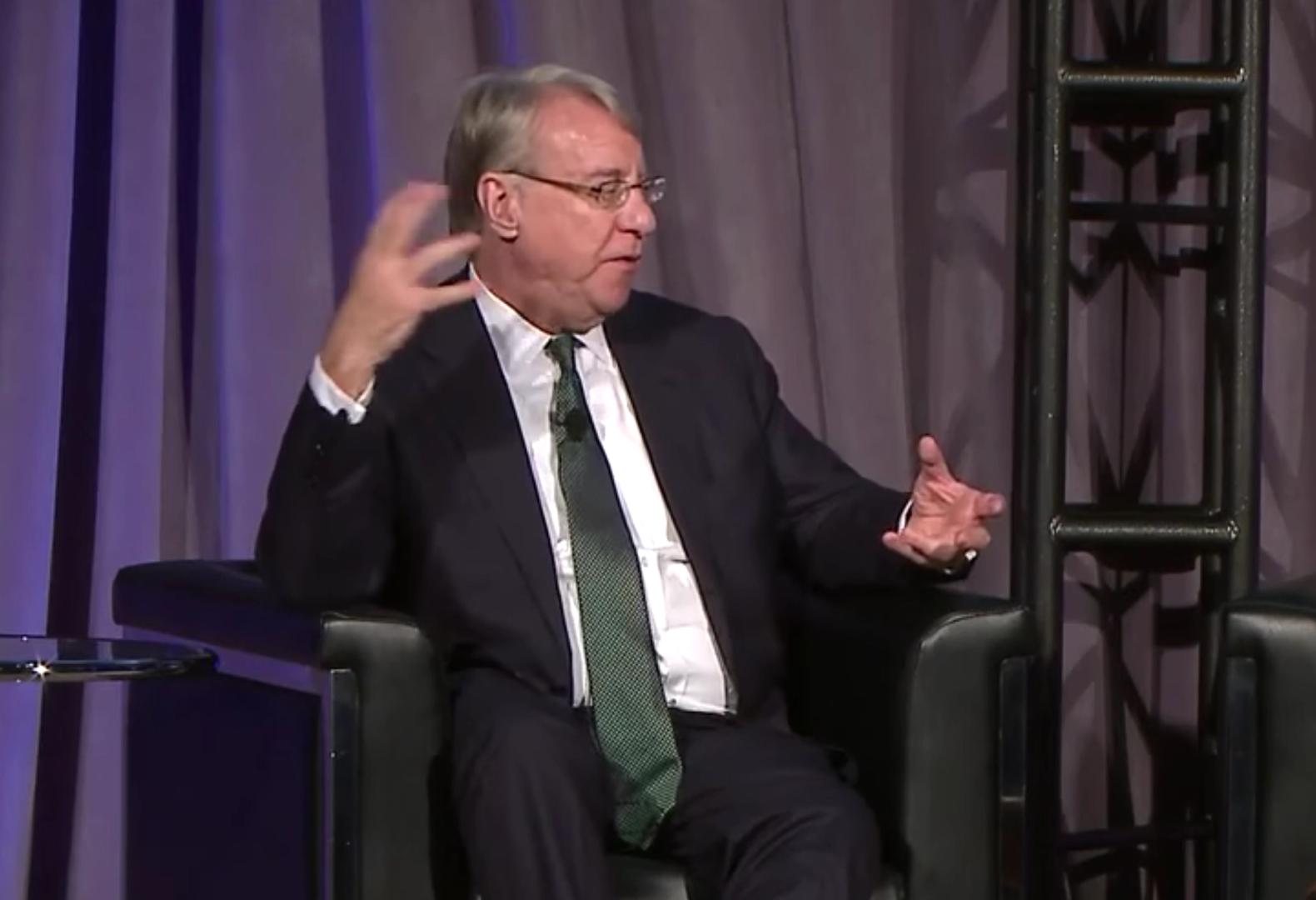

Jim Chanos, the famous short seller best known for anticipating the collapse of Enron in 2001, said he closed his position in Strategy (MSTR), marking the end of an 11-month short MSTR/long Bitcoin. trade. A short position, which involves selling borrowed shares, is a bet that the stock will fall. Closing the position is a signal that further declines are not likely to be significant.

Chanos, known for exposing corporate overvaluation and accounting excesses, first targeted the Strategy when the value of his company (a figure that includes the company’s perpetual preferred and convertible notes) went far beyond the value of his bitcoin holdings. At the time, MSTR’s multiple net asset value (mNAV) was 2.5, a large premium to its underlying bitcoin.

In a note posted on

Valuation compression, combined with Strategy’s continued issuance of common stock, has brought the position to a successful close. Chanos added that while there may be room for further mNAV compression (the premium could eventually stabilize near 1.0, or parity with bitcoin’s adjusted value), the main thesis has largely been met.

Strategy is the largest publicly traded bitcoin holder, with 641,205 BTC on its balance sheet, worth approximately $68 billion at current prices. Unlike all other bitcoin treasury firms, which have fallen into discounts at some point this cycle, the Tysons Corner, Virginia-based company’s stock remained at a premium.

The easing coincided with a turbulent year for the bitcoin treasury sector, which saw bigger names like Metaplanet (3350) and KindlyMD (NAKA) fall more than 80% from their all-time highs.

On Friday, MSTR fell to a 2025 low of around 20% as bitcoin rallied above $105,000, extending its year-to-date gains to around 14%. The completion of the short MSTR/long bitcoin trade could signal a bottom for bitcoin treasury companies.

MSTR shares are up 3% premarket and are trading at $248 per share.