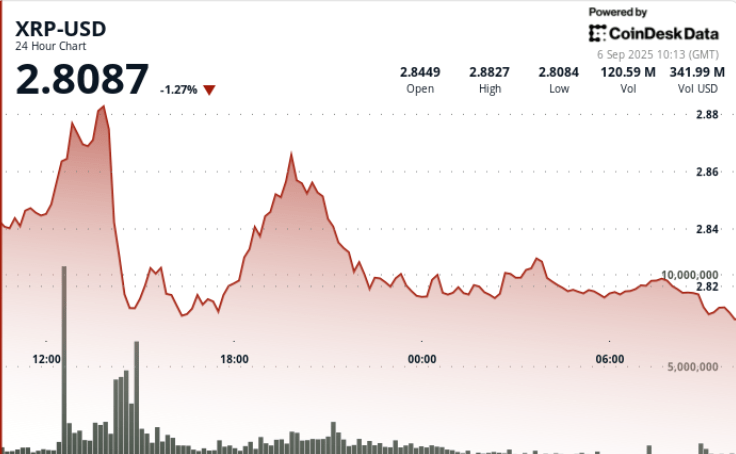

XRP could not maintain an impulse above $ 2.88– $ 2.89, which caused a 4% decrease as the institutional sale limited the progress. The resistance confirmed by heavy volume at those levels, while buyers reappeared in the range of $ 2.81– $ 2.83 to stabilize the price action.

The movement keeps XRP blocked in a consolidation of 47 days below $ 3.00, with the merchants who now look at the support pivot of $ 2.77 and the decisions of ETF SEC in October as the next catalysts.

News history

- Six institutional asset administrators have submitted Spot XRP ETF requests, with expected sec decisions in October.

- The accumulation of whales continues, with approximately 340 million tokens bought in recent weeks despite persistent volatility.

- The exchange balances remain high above 3.5 billion XRP, which raises potential supply pressure issues if curriculums are sold.

- Federal Reserve policy changes and inflation impressions are shaped to broader liquidity conditions among risk assets.

- The previous attempts to break higher saw a tokens trade 227.7 million about $ 2.88– $ 2.89, confirming that area as a firm resistance.

Summary of the price action

- XRP negotiated within a range of $ 0.08 from $ 2.81 to $ 2.89, which represents 3% of volatility.

- The most acute decrease occurred at 2:00 p.m. on September 5, falling from $ 2.88 to $ 2.81 in almost 280 million negotiated tokens.

- The stabilization continued, with consolidation between $ 2.82 and $ 2.83 in lighter volume.

- The closing price about $ 2.82 kept XRP just above the support pivot of $ 2.77, seen as the following railing below.

Technical analysis

- Support: strong supply zone identified at $ 2.77– $ 2.81 after repeated defenses.

- Resistance: immediate roof to $ 2.88– $ 2.89, with a psychological level of $ 3.00 and a rupture threshold of $ 3.30 above.

- Indicators: RSI is in the mid -50s, which reflects the neutral bias to 9 of antenna.

- The MACD histogram converges towards the Alcista crossover, which indicates a possible change of moment if the volume returns.

- Structure: Continuous consolidation of 47 days below $ 3.00, with a potential opening route above $ 3.30 to $ 4.00+.

What merchants are seeing

- If $ 2.77 remains the level of decisive support if curriculums are sold.

- Price behavior in reestimations of $ 2.88– $ 2.89 resistance, particularly if the volume exceeds daily averages.

- How the accumulation of whales compensates for high exchange balances, which suggests a risk of latent supply.

- October Decisions about the ETF Spot XRP, seen as a key institutional adoption catalyst.

- The macro drivers of the Fed policy and the inflation data releases that can influence the flows in digital assets.