Newly unsealed documents from the Department of Justice reveal that Coinbase co-founder Fred Ehrsam was involved in emails related to a $3 million investment from Jeffrey Epstein in 2014, long after Epstein’s initial conviction.

While Epstein’s stake was less than 1% and he played no governance role, records show Ehrsam expressed interest in a meeting during the funding round.

The files show that Epstein’s team had direct communication with Ehrsam, a Coinbase board member and co-founder, who discussed a possible meeting in New York related to a $3 million investment.

“Today I have an interval between noon and 3 pm, but again, it is not crucial for me, but I would be happy to meet him if it is convenient. Is it important to him?” Ehrsam wrote in an email chain that included representatives from crypto entrepreneur Brock Pierce’s venture capital firm, Blockchain Capital. In the same thread, another email claims that Epstein was “at a board meeting yesterday afternoon.”

Coinbase did not respond to a request for comment.

In an email dated December 2, 2014, Pierce, the child actor-turned-entrepreneur who later co-founded Block.one, which in turn launched CoinDesk parent Bullish Global in 2021, contacted Epstein about the opportunity to invest in Coinbase’s Series C fundraising round.

Pierce, who also co-founded Tether and reportedly had a long relationship with Epstein, wrote: “On another diligence call with co-founder. First close happened today. Round should be fully committed on Wednesday. $12M / 20% of round up for grabs. This is the most platinum deal in the space.”

That same day, Epstein asked LinkedIn co-founder Reid Hoffman for advice on whether he should participate in the round. Hoffman responded that he did not have a deep understanding of Coinbase and advised against participating, writing, “I probably wouldn’t play.”

But Epstein ended up investing in the company separately from Blockchain Capital.

Emails from Blockchain Capital co-founder W. Bradford Stephens, dated December 3, 2014, state that Blockchain Capital intended to invest approximately $3.25 million in Coinbase, spread across three affiliated entities.

Within the same email chain, Darren Indyke, a former Epstein associate, identified the investing entity as “IGO Company, LLC, which is a US Virgin Islands limited liability company.”

A valuation report dated December 31, 2014, included in the Department of Justice statement, lists a transaction described as “Purchase of Coinbase through IGO LLC (3,001,000)” and lists Coinbase as an investment made through IGO LLC for that amount.

‘Opportunity to invest’

As more companies and individuals named in Epstein’s documents have sought to distance themselves from him, legal and reputational risk has become a key concern. In 2023, JPMorgan Chase and Deutsche Bank paid a combined $365 million to settle lawsuits brought by Epstein’s victims, who alleged that the banks enabled his sex trafficking operation by providing them with financial services.

In that context, Blockchain Capital, which is widely referenced in the documents, said the original fund investment was never completed.

Blockchain Capital did not respond to a request for comment from CoinDesk, but in a statement emailed to Decrypt, a representative said: “In 2014, Brock Pierce was in contact with Mr. Epstein regarding fundraising. As part of those discussions, the opportunity to invest in Coinbase’s Series C was also discussed via email.”

The representative added that a fund investment “was never consummated” and that Epstein instead invested independently through IGO Company LLC.

However, a few years later, Blockchain Capital attempted to buy Epstein’s stake in the crypto exchange.

In January 2018, Blockchain Capital began discussions with Epstein associate Indyke about purchasing the Coinbase position held through the LLC. “We would be willing to buy the position at a price of $2 billion. [billion] valuation,” Stephens wrote, adding that Blockchain Capital would pay approximately $15 million for the stake.

Subsequent emails show negotiations focused on selling half of Coinbase’s position in IGO LLC. Indyke wrote that Epstein believed the company was worth more than $3 billion and that he had received “two other offers” for the stake.

On January 31, 2018, Stephens responded that Blockchain Capital’s offer to buy 50% of the position at a valuation of $4 billion remained open.

“The price of the 50% interest is $14,666,667,” Stephens wrote, a price that would imply a profit of more than $11 million on the portion of the Coinbase stake sold, according to the emails. In an email dated February 1, 2018, Indyke confirmed the agreement to the transaction, writing, “Jeffrey agrees that he will sell 50% of his LLC to you.”

A valuation report dated August 31, 2018 said Epstein had sold half of his stake in Coinbase, saying “50% was sold for $15 million.” [million] February 2018.”

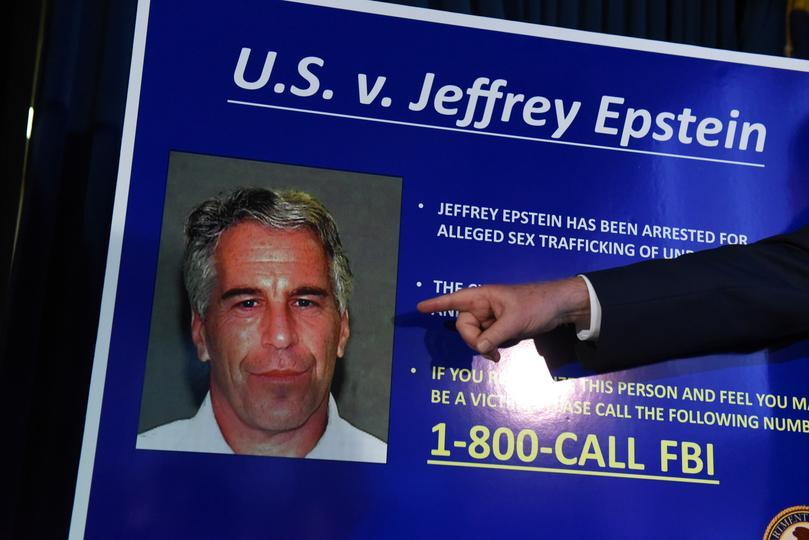

Epstein was arrested on federal sex trafficking charges on July 6, 2019, and was held at the Metropolitan Correctional Center in New York City. He died of suspected suicide on August 10, 2019, after being found unconscious in his cell.