Kalshi, a regulated prediction market platform, has closed a $1 billion funding round that values the company at $11 billion, according to TechCrunch. The round was led by returning investors Sequoia Capital and CapitalG, with participation from Andreessen Horowitz, Paradigm, Anthos Capital and Neo.

The new valuation brings Kalshi closer to the $12 billion to $15 billion valuation target that its crypto rival Polymarket is reportedly seeking. The milestone also comes just a month after Kalshi announced a $300 million round at a $5 billion valuation, underscoring investor appetite for the growing prediction market space.

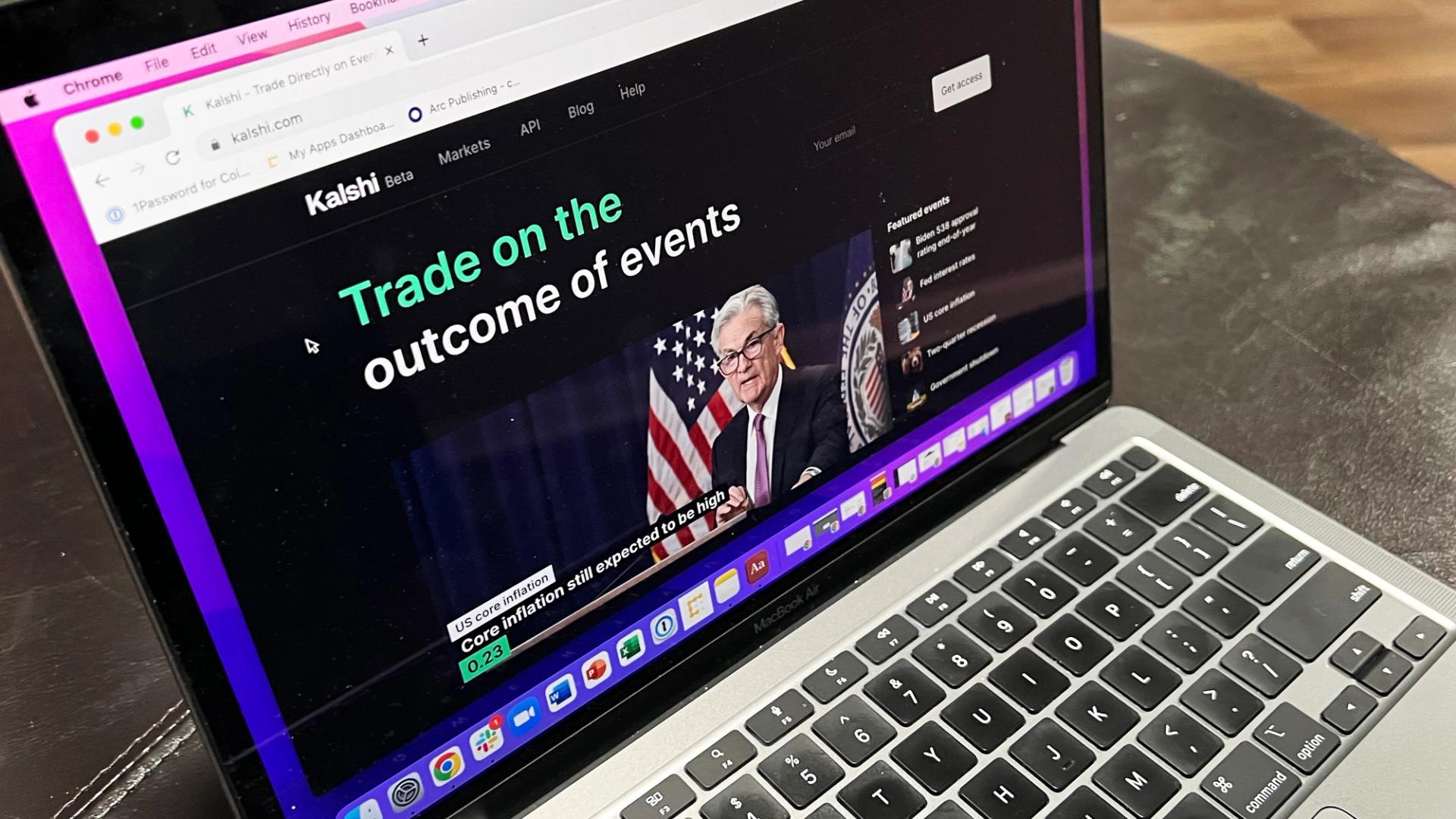

Kalshi operates as a regulated exchange under the supervision of the Commodity Futures Trading Commission (CFTC), and offers event contracts on topics ranging from inflation rates to political outcomes. It has positioned itself as a US-friendly alternative to offshore or decentralized platforms, focusing on institutional and retail traders who want legal certainty and fiat gateways.

Polymarket, on the other hand, is built on blockchain rails and operates as a decentralized information marketplace. Users bet cryptocurrencies on yes-or-no outcomes, often tied to political elections, market data or pop culture events.

The two companies have become pioneers in a sector that combines financial speculation with news-driven engagement. While Kalshi touts regulatory compliance and a path to widespread adoption, Polymarket’s decentralized design appeals to crypto-native users seeking transparency and censorship resistance.