By Francisco Rodrigues (All Times et unless indicated otherwise)

Cryptocurrency prices are increasing after the old cryptocurrency compliance unit of the US Securities and Securities Commission. from Atlanta, Raphael Bostic.

To renounce the name of cryptographic assets and cyber unit is significant because it shows that the agency is moving away from its cryptographic approach that often led to accusations of regulation by the application and legal battles with the main participants of the industry.

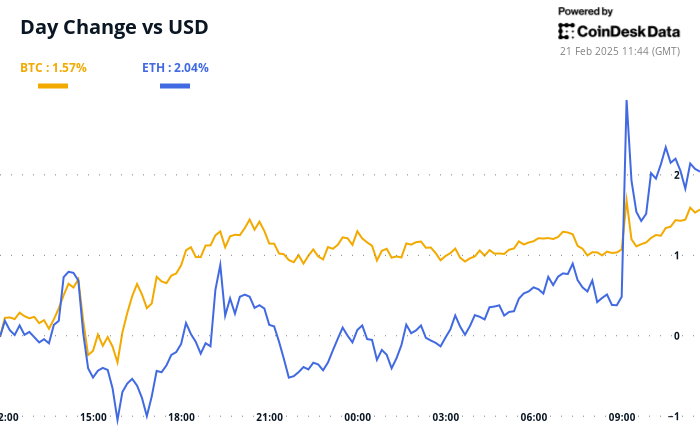

“In the term close to medium, the clearest regulations will probably increase institutional participation, which leads to improvements in market infrastructure,” Backpack, Armani Ferrante, told COINDESK, founder and CEO. Bitcoin is now above $ 98,000 after adding 1.2% in 24 hours, while the broader Coindesk 20 index increased 1.35%.

However, volatility remains relatively low. “These environments can feel slow and frustrating, but they rarely persist for a long time: volatility tends to mean reverting,” said Winter OTC merchant Jake or Coindesk.

With the growth of tensions between the United States and its European allies, investors expect Germany’s elections on Sunday to lead to a stable coalition government that eliminates economic reforms to stimulate growth and increase defense expense. Germany is the largest economy in Europe and a positive result could lead to a more risk approach.

The open interest has already advanced before the elections. Even so, the cryptographic market lacks positive catalysts in the short term, wrote JPMorgan analysts led by Nikolaos Panigirtzoglou in a report.

In fact, the market is about to decline, where stained prices increase above the prices of futures, in a “negative development” that is “indicative of demand weakness” by institutional investors who use contracts Regulated by futures CME to obtain market exposure. Stay alert!

What to see

- Crypto:

- Macro

- February 21, 9:45 am: S&P Global is launched to the reports of the United States Purchasing Manager Index (Flash) of February.

- PMI PMI Compound Prev. 52.7

- PMI manufacturing est. 51.5 vs. Prev. 51.2

- PMI services est. 53 vs. Prev. 52.9

- February 24, 5:00 am: Eurostat releases Eurozone consumer inflation (final) for January.

- YOY EST Nucleus inflation rate. 2.7% vs. Prev. 2.7%

- Yoy Est inflation rate. 2.5% vs. Prev. 2.4%

- February 21, 9:45 am: S&P Global is launched to the reports of the United States Purchasing Manager Index (Flash) of February.

- Earnings

- February 24: riot platforms (Riot), post -market, $ -0.18

- February 25: Bitdeer Technologies Group (BTDR), Pre -Mercado, $ -0.17

- February 25: encryption mining (encryption), pre -market, $ -0.09

- February 26: Mara Holdings (Mara), Post -Mercado, $ -0.13

Token events

- Government votes and calls

- You unlock

- February 21: Rapid Token (FTN) to unlock 4.66% of the circulating offer worth $ 78.6 million.

- February 28: Optimism (OP) to unlock 1.92% of the circulating offer worth $ 34.23 million.

- March 1: SUI (SUI) will unlock 0.74% of the circulating offer for a value of $ 81.07 million.

- Lanza Token

Conferences:

Coindesk’s consensus will be carried out in Toronto from May 14 to 16. Use the code code and save 15% in passes.

Token talk

By Oliver Knight

- With a failed launch of Argentine President Javier Milei and a file proposed by the Nazi Kanye West self -proclaimed, now known as Ye, this week in Memecoin Land has been one to forget.

- Castle Island Ventures’s partner, Nic Carter, said that madness has “no doubt”, a view that could be consolidated by a report that reveals that West is planning to enter Token yzy, and will have 70% of the supply.

- The rest of the cryptographic market remains relatively imperturbable due to the possible disappearance of the sector: ETH and LTC increase by 3% this week, while TRX has increased by 7.7% as liquidity seems to be turning from speculative tokens to projects to projects More utilitarians.

- Nearby the package leads on Friday, emerging by 11% after announcing agents of the “first true autonomous”. Agents may autonomously own, exchange and manage assets in the chain.

Derivative positioning

- BTC’s open interest in centralized exchanges increased almost 5% to $ 37.3 billion in the last 24 hours. This, together with the reversal in the financing from positive to negative, suggests a possible short -tight scenario. Short liquidations have dominated futures markets during that period, about a total of $ 110 million compared to $ 6.11 million in lengths.

- Among the assets with more than $ 100 million in open interest, the manufacturer DAO, Virtuals Protcol and the artificial intelligence saw the highest increase of one day, increasing by 39.2%, 35.5%and 28.00%, respectively.

- Among the options, the purchase option in BTC with an exercise price of $ 99,000 and expired on February 22 has negotiated with the highest volume of detribit. The following most popular options is the call to BTC with an exercise price of $ 108,000, which expires on February 28. The action suggests the optimistic feeling in the market in the market in recent days.

Market movements:

- BTC increases 0.28% from 4 PM ET on Thursday to $ 98,632.42 (24 hours: +1.35%)

- ETH has risen 2.09% to $ 2,800.02 (24 hours: +2.15%)

- COINDESK 20 increases 0.92% to 3,298.29 (24 hours: +1.49%)

- The commitment rate composed of CESR Ether does not change to 2.99%

- The BTC financing rate is at 0.0010% (1,0961% annualized) in Binance

- DXY has risen 0.29% to 106.68

- Gold has dropped 0.31% to $ 2,929.76/oz

- La Plata has dropped 0.12% to $ 32.91/oz

- Nikkei 225 closed +0.26% at 38,776.94

- Hang Seng closed +3.99% at 23,477.92

- Ftse has risen 0.20% to 8,680.19

- Euro Stoxx 50 increased 0.18% to 5.471.08

- Djia closed on Thursday to -1.01% to 44,176.65

- S&P 500 Closed -0.43% at 6,117.52

- Nasdaq closed -0.47% to 19,962.36

- S&P/TSX Compiete Index Closed -0.44% at 25,514.08

- S&P 40 Latina America closed +0.76% at 2,480.21

- The 10 -year Treasury rate of US

- E-mini s & p 500 futures have not changed to 6,138.25

- E-mini nasdaq-100 futures have increased 0.13% to 22,170.75

- E-mini dow Jones The industrial average of the index of the futures has increased by 0.10% to 44,309

Bitcoin statistics:

- BTC domain: 61.02 (-0.35%)

- Bitcoin Ethereum ratio: 0.02842 (2.01%)

- Hashrat (seven -day mobile): 807 eh/s

- Hashprice (spot): $ 54.92

- Total rates: 5.34 BTC / $ 526,892

- CME Future Open Interest: 178,500 BTC

- BTC with a gold price: 33.4 oz

- BTC vs Gold Market Cap: 9.49%

Technical analysis

- Tao has become one of the strongest assets during the past week, driven by the launch of the Dynamictao update. This impulse has promoted the price on all key exponential mobile averages in the daily time frame, which indicates a renewed resistance.

- In addition to the upward feeling, the price action has formed a reverse pattern of head and shoulders.

- The recent Tao list in Coinbase provided an additional catalyst, which raised its price at almost 20% to a maximum of $ 495 from the initial announcement.

Cryptographic equities

- Microstrategy (MSTR): closed on Thursday at $ 323.92 (+1.65%), 0.37% more at $ 324.85 in the previous market

- Global Coinbase (Coin): Closed at $ 256.59 (-0.80%), 0.86% more at $ 258.80

- Galaxy Digital Holdings (GLXY): Closed at C $ 25.65 (+1.30%)

- Mara Holdings (Mara): closed at $ 15.95 (+1.08%), 0.38% more at $ 16,01

- Riot Platforms (Riot): closed at $ 11.60 (+0.35%), 0.52% more at $ 11.66

- Core Scientific (Corz): Closed at $ 11.84 (-1.50%), 0.51% higher than $ 11.90

- CleanSTark (CLSK): closed at $ 10.06 (+1.72%), 0.80% higher to $ 10.14

- COINSHARES VALKYRIE BITCOIN MINERS ETF (WGMI): closed at $ 22.49 (-1.27%), 0.31% at $ 22.42

- Semler Scientific (SMLR): closed at $ 52.24 (+0.04%), without changes

- Exodus movement (exod): closed at $ 47.80 (-1.26%), less than 2.72% at $ 46.50

ETF flows

Spot BTC ETF:

- Daily net flow: -$ 364.8 million

- Cumulative net flows: $ 39.63 billion

- Total BTC holdings ~ 1,169 million.

Spot Eth Ethfs

- Daily net flow: -$ 13.1 million

- Cumulative net flows: $ 3.16 billion

- Total eth holdings ~ 3,807 million.

Source: Farside Investors

Flows during the night

Figure of the day

- Bitcoin’s price action has caused short liquidations for a total of $ 97.9 million at the level of $ 98,890, according to Coinglass. The following key resistance levels, based on the liquidation heat map, are $ 99,185 and $ 99,332, where liquidations with a value of $ 65.2 million and $ 67.9 million, respectively, are grouped.

- On the negative side, significant long liquidations are placed at $ 97,415 and $ 97,194, worth $ 69.3 million and $ 70.7 million, respectively. These key levels highlight potential volatility areas as Bitcoin navigates its current price range.

While you sleep

- Crypto Market faces a weak demand, you need Trump initiatives to activate, JPMorgan says (Coindesk): JPMorgan said that CME’s futures data reveal a weak institutional interest in the crypto year.

- The South African firm to accumulate Bitcoin Hoard in First for Continent (Bloomberg): Altvest Capital adopted Bitcoin to be a treasure reserve asset. He bought a BTC and is considering a sale of shares of $ 10 million to expand their digital holdings.

- Block actions fall into profits, Miss Income (CNBC): in their 2024 fourth -quarter profit call, block executives (XYZ) commented on proto, their Bitcoin mining initiative. CFO Amrita Ahuja said the project should boost growth in the second half.

- Japan returns when Ueda warns that Boj can intervene in the soft market (Bloomberg): the governor of the Bank of Japan, Kazuo Ueda, promised to buy government bonds if long -term yields increase. Previously, yields of 10 years reached 1,455%, as many since 2009.

- Retail sales of the United Kingdom increases for the first time in five months (The Wall Street Journal): In January, retail spending in the United Kingdom increased 1.7% as of December, led by a jump of 5.6% in food store sales as more people ate at home.

- The new Microsoft chip shortens the timeline to make Bitcoin resistant to quantity: River (Cointelegraph): the financial services firm focused on Bitcoin River River said that Microsoft’s Majorana, although it is not yet a pleasant attacks against The block chain.

In the ether