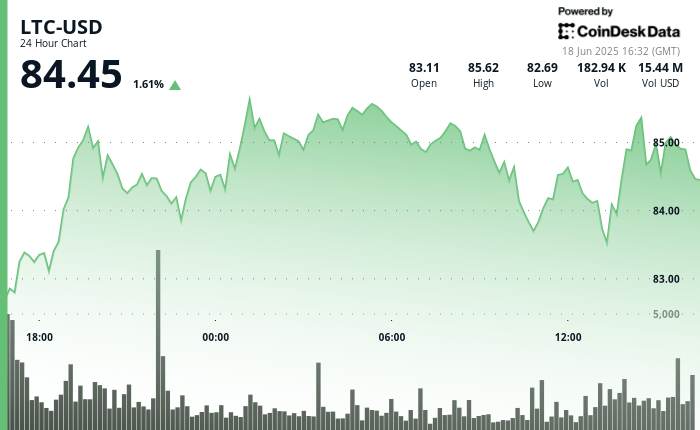

Litecoin raised early losses on Tuesday to obtain a daily gain of 1.6%, which is quoted above $ 84.6 after diving to $ 82.69.

The rebound occurred despite the fact that the choppy markets reacted to high tensions that surround the war between Israel and Iran, which has maintained the markets at the limit, with the probabilities of an American military action in the region before the end of this month now is now 62% according to the Polymket merchants.

Digital assets, often sensitive to macroeconomic stress, reflected the nerves. However, Litecoin showed an unusual resilience, recovering near a key resistance at $ 85.6, according to Coindensk Research technical analysis data.

The merchants are seeing the review of the SEC of the Spot Litecoin ETF applications. Polymercados merchants now have a priced at 76% approval possibilities this year.

General description of the technical analysis

- Litecoin registered a gain of 1.6% during the 24 -hour period, rising from a minimum of $ 82.69 to close to $ 84.88. The broader market, measured by the Coindesk 20 index (CD20), fell 0.5% during the same period.

- The support solidified in the range of $ 83.48– $ 83.57, according to the technical analysis model of Coindesk Research, where buyers intervened with a volume greater than the average.

- This purchase interest established a floor that helped LTC returning despite intra -intradia volatility. The resistance arose at $ 85.60– $ 85.67, an area that was tested twice but was not violated.

- The price action developed an ascending channel, marked by higher minimums, a constant bullish impulse sign even when sellers limited profits.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.